What’s Inside This Guide?

Let's be honest. You've probably looked at the RSI indicator on your chart, seen it hit "overbought," and thought, "Time to sell!" only to watch the price keep rocketing higher without you. I've been there. That frustration is why most explanations of the Relative Strength Index fall short. They teach you what the lines mean but not how to think with them.

This isn't another rehash of the formula. We're going to talk about how the RSI feels in different market conditions—when it's trustworthy, when it lies to your face, and how to build a simple, effective plan around it.

What is the RSI Indicator? It’s Not an Oscillator

First, a quick myth-bust. Everyone calls the RSI a "momentum oscillator." That's technically true, but it frames it wrong. It makes it sound like a weather vane, spinning with every breeze. In reality, the RSI (Relative Strength Index), created by J. Welles Wilder Jr., is more like a speedometer for price moves.

It doesn't measure direction (up or down). It measures the velocity and magnitude of recent price changes. Is the current move up happening with forceful, sustained buying (high RSI)? Or is it a weak, tired rally that's running out of steam (lower RSI on an up move)? That's the core question it answers.

How Does the Relative Strength Index (RSI) Indicator Work?

The classic calculation uses a 14-period setting (usually 14 days on a daily chart). It compares the average size of recent up-closes to the average size of recent down-closes and smooshes that ratio into a number between 0 and 100.

- Formula (Simplified): RSI = 100 – [100 / (1 + (Average Gain / Average Loss))]

You don't need to calculate this by hand. Your charting software does it. What you need to understand is the story the number tells:

- RSI above 70: Recent gains have been significantly larger than recent losses. Momentum is strongly to the upside. Traders label this "overbought," which can be misleading.

- RSI below 30: Recent losses have been significantly larger than recent gains. Momentum is strongly to the downside. This gets labeled "oversold."

- RSI around 50: Forces are roughly balanced. There's no strong momentum bias.

The standard 70/30 levels are arbitrary but useful as zones of attention, not hard triggers.

The "Overbought" Trap

This is where new traders lose money. "Overbought" does NOT mean "must reverse immediately." In a powerful bull trend (think NVIDIA in 2023), the RSI can camp out above 70 for weeks. Selling just because it crossed 70 would have meant missing the biggest moves. Overbought means momentum is hot. In a trend, hot momentum can stay hot.

The "Oversold" Mirage

Same logic in reverse. In a brutal bear market, the RSI can languish below 30. Buying the first dip into "oversold" is a classic way to catch a falling knife. Oversold means momentum is intensely negative. In a downtrend, that can persist.

Using the RSI Practically: The Good, The Bad, The Ugly

Let's move to practical application with a clear-eyed view of its strengths and flaws.

The Good: Where RSI Shines

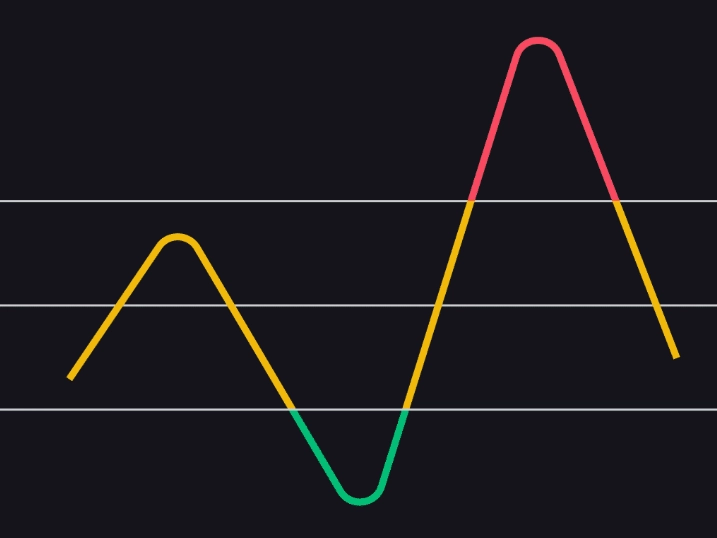

1. Spotting Divergences (Its Killer App): This is the RSI's most valuable signal.

- Bearish Divergence: Price makes a new higher high, but the RSI makes a lower high. This means price is rising, but the upside momentum is weakening. It's a warning sign of a potential reversal down.

- Bullish Divergence: Price makes a new lower low, but the RSI makes a higher low. Price is falling, but selling momentum is fading. Hints at a potential reversal up.

I look for divergences right at those 70/30 zones. A bearish divergence near 75 is much more concerning than one at 55.

2. Identifying Range-Bound Markets: When a stock or currency is chopping sideways in a range, the RSI becomes a fantastic tool. It will regularly bounce between 70 and 30, often giving clean reversal signals at the range's support and resistance. This is its most textbook, reliable environment.

The Bad & The Ugly: RSI's Weaknesses

It's Terrible in Strong Trends. This is the #1 reason for failed RSI signals. In a strong, steady uptrend, the RSI will give "overbought" sell signals early and often, leaving you on the sidelines. In a powerful downtrend, it will flash "oversold" buy signals all the way down.

It's a Lagging Indicator. The RSI is calculated on past prices. It confirms what already happened. By the time it hits 30, the drop is already significant. Don't expect it to call the exact top or bottom.

Advanced RSI Concepts Most Traders Miss

1. RSI Failure Swings (Hidden Reversals)

These are powerful but subtle.

- Bearish Failure Swing: RSI peaks above 70 (overbought), pulls back, rallies again but fails to reach 70, then breaks its prior pullback low. This "failure" to get back to overbought often precedes a strong down move.

- Bullish Failure Swing: RSI bottoms below 30 (oversold), bounces, dips again but fails to reach 30, then breaks its prior bounce high. This "failure" to get back to oversold can signal a strong up move.

It's the RSI's own internal trend break, and it often leads price.

2. Using Different Timeframes for Confluence

Don't just look at the RSI on your entry chart. Check the higher timeframe.

- Scenario: You're looking at a 1-hour chart for a buy entry. The hourly RSI is rising from oversold—looks good. But you check the daily chart, and its RSI is just breaking below 50 into bearish momentum. That daily context tells you any hourly bounce is likely just a correction in a larger downtrend. The higher timeframe RSI gives you the strategic context.

3. Adjusting the RSI Setting

The default is 14. It's not a holy number.

| Setting | Character | Best For... |

|---|---|---|

| RSI (7) | More sensitive, more signals (noisy). | Short-term/day trading, catching quick reversals. |

| RSI (14) | Standard, balanced. | General swing trading, daily charts. |

| RSI (21 or 25) | Slower, smoother, fewer signals. | Identifying longer-term momentum shifts, filtering out noise. |

A smoother RSI (21) might show a clear bullish divergence where the noisy RSI (7) shows nothing but chaos. Experiment.

Building the RSI Into Your Trading Plan

Here’s a simple, actionable framework. The RSI is not the whole plan; it's a component.

Step 1: Determine the Trend (The Filter)

Use a moving average (e.g., 50-period EMA) on your chart.

- Uptrend Rule: Price > EMA. Only consider RSI buy signals (oversold bounces, bullish divergences). Ignore or be very cautious with sell signals.

- Downtrend Rule: Price Only consider RSI sell signals (overbought rejections, bearish divergences). Avoid buy signals.

This one step eliminates ~50% of losing RSI trades.

Step 2: Find the Signal (The Trigger)

Within the trend, wait for the RSI to give a setup.

- For a long in an uptrend: Look for RSI dipping to or below 30 and starting to curl up, or better yet, a bullish divergence.

- For a short in a downtrend: Look for RSI rallying to or above 70 and curling down, or a bearish divergence.

Step 3: Get Price Confirmation (The Safety Net)

Don't buy/sell just because the RSI moved. Wait for price action to agree.

- If you see a bullish RSI divergence in an uptrend, don't buy the divergence. Wait for price to break a minor downtrend line or a key resistance level after the divergence forms.

- This ensures the momentum shift the RSI hinted at is actually translating into price movement.

Step 4: Manage Your Risk (The Exit)

The RSI can help with exits too, but don't be rigid.

- Trailing Stop: In a strong trend, use a moving average or recent swing low instead of the RSI to stay in the trade.

- Profit Target/Exit Signal: Consider taking partial profits when the RSI reaches the opposite extreme (e.g., RSI hits 75-80 on a long trade from oversold). The full exit can be on a break of your trailing stop or the appearance of a bearish divergence.

Your RSI Questions, Answered

The RSI isn't a magic bullet. It's a gauge. A speedometer tells you you're going 100 mph, but it doesn't tell you if you're about to hit a wall or if the road is clear ahead. You need to look out the window (the price chart) for that.

Stop looking for the perfect RSI signal. Start using it to answer one simple question: "Is the momentum behind this current price move strong or weak?" Then, align that answer with the trend and key price levels. That's how you move from being frustrated by the RSI to having it quietly improve your trading decisions.