What does TTM mean in finance? This guide explains Trailing Twelve Months, why it's crucial for investment analysis, how to calculate it, and common mistakes to avoid when using TTM metrics.

What does lead time mean in business and how can you accurately calculate and reduce it? This ultimate guide explains lead time meaning across industries, provides formulas, and shares expert strategies to optimize your processes.

What does Ltd mean for your business? This definitive guide explains the legal meaning of 'Limited', its key advantages like liability protection, the crucial differences between Ltd and Inc, and a step-by-step look at how to register one.

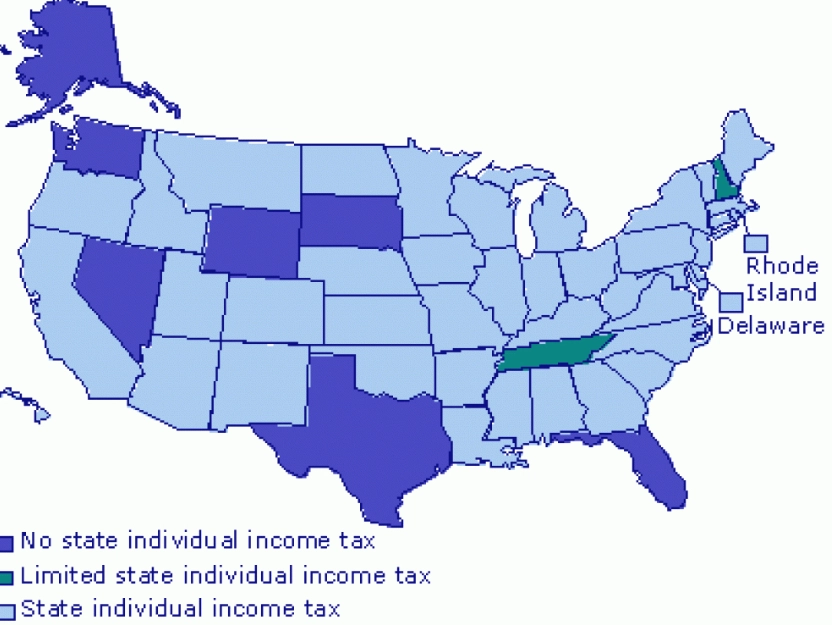

Wondering what states don't have income tax? This complete guide lists all 9 tax-free states, compares their other taxes and cost of living, and helps you decide if moving for tax savings is right for you.

What exactly does 'trust fund meaning' entail? This comprehensive guide breaks down how trust funds work, their different types, key benefits for asset protection and estate planning, and a step-by-step look at how to set one up, moving beyond the stereotype.

Thinking about shorting stocks but unsure where to start? This expert guide walks you through the entire process, highlights critical risks often overlooked, and offers actionable strategies to protect your capital while potentially profiting from market declines.