Bitcoin mining is the engine that keeps the entire Bitcoin network running. Forget the image of someone with a pickaxe. It's a global, digital competition where powerful computers race to solve a complex math puzzle. The winner gets to add a new "block" of transactions to Bitcoin's permanent record (the blockchain) and is rewarded with brand new bitcoin. That's the simple version. But how it actually works, why it's so hard to start today, and whether you can make money doing it—that's where things get interesting. Let's strip away the jargon.

Quick Navigation: What You'll Learn

What Bitcoin Mining Really Is (And Isn't)

First, a crucial correction. Mining isn't about creating bitcoin out of thin air for the sake of it. It serves three critical, interconnected purposes:

1. Transaction Verification: Miners are auditors. They collect pending Bitcoin transactions from the network, verify their legitimacy (Is the sender's signature valid? Do they have enough bitcoin?), and batch them into a candidate block.

2. Securing the Network: This is the big one. By forcing miners to expend real-world energy (electricity) to add a block, Bitcoin makes it astronomically expensive to attack the network. To alter a past transaction, an attacker would need to re-mine that block and all blocks after it, outpacing the entire honest network. The cost is designed to be far greater than any potential reward.

3. Distributing New Coins: The block reward is the incentive that makes points 1 and 2 possible. It's how new bitcoin enters the system in a predictable, controlled way, following the schedule laid out in Satoshi Nakamoto's original whitepaper.

The Technical Core: How Mining Actually Works

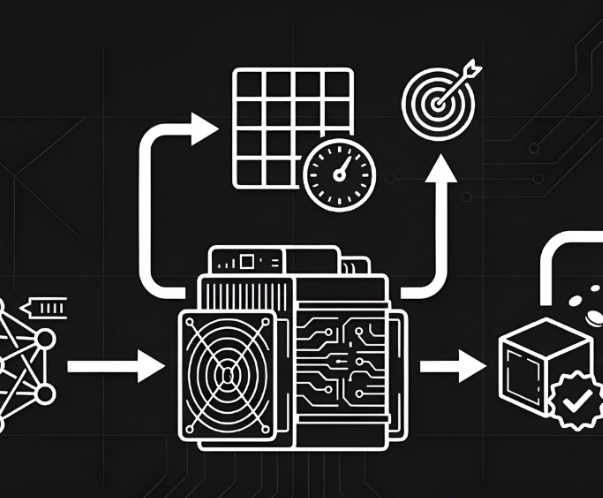

Let's walk through the process from transaction to confirmed block.

Step-by-Step: From Transaction to Block

You send 0.1 BTC to a friend. That transaction is broadcast to the peer-to-peer network. Special nodes called "miners" are listening. They don't just take your transaction; they collect thousands of others into a holding area called the "mempool."

The miner's job is to build a valid block from these waiting transactions. They select transactions, often prioritizing those with higher attached fees (to maximize their own reward). They then run this data—the transaction list, the previous block's ID, and a temporary number called a "nonce"—through the SHA-256 cryptographic hash function.

This function spits out a unique, 64-character string of numbers and letters called a hash. It looks like random gibberish: 0000000000000000000a9b7c...etc.

The Role of the Nonce

Here's the puzzle. The network sets a target hash. To win, the miner must find a hash for their block that is numerically lower than this target. Because the hash function is deterministic (same input always gives same output), the only way to get a different hash is to change the input.

That's the nonce's job. It's just a number the miner changes over and over. They try "1," hash. Doesn't work. Try "2," hash. Doesn't work. They try trillions, quadrillions of nonces per second.

It's pure, brute-force guessing.

When a miner finally finds a nonce that produces a hash below the target, they broadcast the new block to the network. Other nodes easily verify it's correct (they just hash the block data once). Once confirmed, the block is linked to the chain, your transaction is settled, and the miner claims their reward.

The Heart of the System: Mining Difficulty

This is the most misunderstood and genius part of Bitcoin mining. The "target hash" isn't fixed. The network aims for a new block every 10 minutes, on average.

What happens if more miners join with faster machines? Blocks would be found too quickly.

So, every 2,016 blocks (about two weeks), Bitcoin automatically adjusts the mining difficulty. If blocks were found faster than 10 minutes, the difficulty goes up (the target hash gets smaller, making it harder to hit). If they were found slower, difficulty goes down.

This feedback loop is why you can't just buy a faster computer and expect more bitcoin. The network fights back. Your slice of the global pie—your "hash rate" share—is what matters. When you see headlines about "mining difficulty hitting all-time highs," it means the collective computing power of the network is immense, and the competition is fiercer than ever.

How to Start Bitcoin Mining (A Realistic Guide)

Forget using your laptop. Here's what modern Bitcoin mining actually involves, with real-world specifics.

| Method | What It Is | Hardware Example & Cost | Pros & Cons |

|---|---|---|---|

| ASIC Mining (Solo/Pool) | Using specialized Application-Specific Integrated Circuit machines designed solely for Bitcoin mining. | Antminer S19 XP Hydro (255 Terahashes/sec). Cost: ~$4,000 - $6,000+ (varies widely). | Pro: The only profitable hardware for serious miners. Con: Very loud (sounds like a jet engine), generates massive heat, requires industrial-grade cooling and electrical setup (240V). |

| Cloud Mining | Renting hash power from a company that owns and operates the ASICs. | Contracts from platforms like NiceHash or ECOS. You pay for a set amount of hash power for a duration. | Pro: No hardware noise, heat, or setup. Con: Fraught with scams. Many contracts are unprofitable after fees. You don't control the asset. I'm generally skeptical of this model. |

| Mining Pools | Combining hash power with other miners to solve blocks more consistently and share rewards proportionally. | You still need your own ASIC. You then connect it to a pool like Foundry USA, Antpool, or ViaBTC. | Pro: Smoothes out earnings from lottery-like to a small, steady stream. Con: You pay a pool fee (usually 1-3%). You are reliant on the pool's honesty. |

The biggest hurdle isn't even the miner cost. It's operational costs.

A modern ASIC like an Antminer S19 uses about 3,250 watts. Run it for a month (24/7), and that's about 2,340 kWh of electricity. At an average U.S. residential rate of $0.15 per kWh, that's $351 per month just in power. In many parts of Europe, where rates can be $0.30-$0.40, it's instantly unprofitable. Miners seek out locations with sub-$0.05/kWh electricity, often near renewable sources or with stranded energy.

Is Bitcoin Mining Profitable? A Data-Driven Look

Profitability is a moving target. It depends on four volatile variables:

1. Bitcoin's Price: Higher price = higher value of block rewards and fees.

2. Your Electricity Cost: The single most important factor for an individual.

3. Network Difficulty: Constantly rising as more miners join.

4. Hardware Efficiency: Measured in Joules per Terahash (J/TH). Lower is better.

Let's run a simplified, sobering scenario:

- Miner: Antminer S19j Pro (100 TH/s, 3,050 Watts).

- Electricity Cost: $0.08 per kWh (a relatively good rate).

- Bitcoin Price: $60,000.

- Pool Fee: 2%.

Using a mining profitability calculator, this setup might generate roughly $5-$7 of revenue per day. Daily electricity cost would be about $5.85. Your daily profit? Maybe $1-$2, before considering the initial $2,000+ hardware cost, cooling, internet, and maintenance.

It's a razor-thin margin business for the little guy. A 10% swing in Bitcoin's price or a difficulty increase can wipe out profits for weeks. This is why mining has become dominated by large, professionally run operations with access to ultra-cheap power and economies of scale.

For most people, buying bitcoin directly on an exchange is a far more capital-efficient and less operationally intensive way to gain exposure.

Your Bitcoin Mining Questions Answered

Understanding Bitcoin mining demystifies the entire system. It's not magic internet money. It's a carefully engineered, incentive-driven machine where security is bought with electricity. While the gold rush days for solo miners are gone, the process remains the foundational innovation that makes a decentralized digital currency possible. Whether you ever run a miner or not, knowing how it works makes you a more informed participant in the crypto space.