Let's be honest. When you hear "mine bitcoin," you probably think of quick money, magical internet coins, and maybe a guy in a basement getting rich. The reality is grittier, louder, and a lot more technical. Bitcoin mining is the competitive process of securing the Bitcoin network and earning newly minted bitcoins as a reward. It's not a get-rich-quick scheme; it's a complex, capital-intensive industrial operation that has moved far beyond hobbyist tinkering.

I built my first mining rig in 2017. It was loud, hot, and after six months, the electricity bill made it clear I was better off just buying bitcoin directly. That lesson cost me a few thousand dollars. Today, the landscape is even more competitive. This guide won't sell you dreams. It will show you the actual steps, costs, and harsh realities of Bitcoin mining so you can decide if it's a viable path for you, whether as a serious business or an expensive educational hobby.

What’s Inside This Guide

How Bitcoin Mining Actually Works (No Fluff)

Forget the pickaxe and shovel analogy. Think of a global, decentralized lottery.

Thousands of specialized computers (called miners) compete to solve a complex mathematical puzzle. This puzzle is linked to a batch of pending Bitcoin transactions (a "block"). The first miner to solve the puzzle gets to add that new block to the Bitcoin blockchain. As a reward for this work—which essentially secures and validates the network—the miner receives a fixed amount of newly created bitcoin (the block reward, currently 3.125 BTC after the 2024 halving) plus any transaction fees users attached to their payments.

The key metric is hash rate: the number of guesses your machine can make per second. It's measured in terahashes (TH/s) or exahashes (EH/s). A higher hash rate increases your odds of winning the lottery. The network's total hash rate adjusts the puzzle difficulty every two weeks to ensure a new block is found roughly every ten minutes, regardless of how many miners join or leave.

This is why you can't mine with a laptop anymore. Your hash rate would be a drop in an ocean of specialized machines. Your chance of winning solo is effectively zero. That's why mining pools exist. Pools combine the hash power of thousands of miners to find blocks more consistently, then share the rewards proportionally based on each member's contributed work. You get smaller, more frequent payouts instead of a tiny chance at a huge jackpot.

The Expert Reality Check: Most explanations stop at "miners secure the network." The subtle point they miss? Mining is a real-time financial arbitrage game. Your profit is the difference between the dollar value of the bitcoin you earn and the dollar cost of the electricity you burn to earn it. If the bitcoin price falls or your power cost spikes, a profitable operation can turn loss-making overnight. You're not just a technician; you're a energy trader.

What You Really Need to Start Mining Bitcoin Today

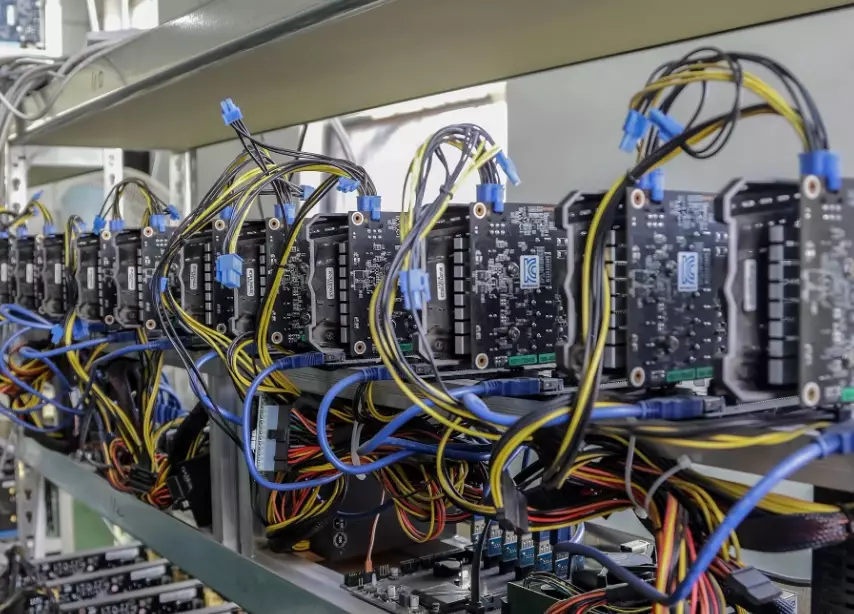

Gone are the days of using a graphics card. Today, Bitcoin mining is done exclusively with Application-Specific Integrated Circuits (ASICs). These are machines designed to do one thing: compute SHA-256 hashes as efficiently as possible. They're expensive, power-hungry, and sound like a jet engine.

Choosing Your Hardware: The ASIC Reality

Your choice dictates everything—profitability, noise, heat, and setup complexity. Don't just buy the newest model. Efficiency (joules per terahash, or J/TH) is more important than raw hash rate if your electricity isn't free.

| Model (Example) | Hash Rate | Power Consumption | Efficiency (J/TH) | Est. Cost (2024) | Best For |

|---|---|---|---|---|---|

| Bitmain Antminer S21 Hyd 335T | 335 TH/s | ~5360W | 16 J/TH | $5,500 - $6,500 | Large-scale farms with immersion cooling. |

| Bitmain Antminer S21 200T | 200 TH/s | ~3010W | 15 J/TH | $3,000 - $4,000 | Serious home miners with excellent power rates ( |

| MicroBT Whatsminer M50S++ | 126 TH/s | ~3276W | 26 J/TH | $1,500 - $2,200 | Budget-conscious starters (but higher operating cost). |

| Bitmain Antminer S19j Pro+ 122T | 122 TH/s | ~3355W | 27.5 J/TH | $1,200 - $1,800 (used) | Learning the ropes; lower upfront cost, higher power bill. |

My advice? For a first-timer, a used S19 series from a reputable seller can be a smart move. The upfront cost is lower, and if mining doesn't work out, your capital risk is reduced. The newer S21 models are fantastic but require you to be very confident in your power setup and long-term commitment.

The Hidden Costs Everyone Forgets

The miner price is just the ticket to the game. The real budget killers are behind the scenes:

Electricity Infrastructure: A single ASIC needs a dedicated 240V circuit, like what powers your dryer or oven. You may need an electrician to install this. Don't even think about using multiple adapters on a standard 120V outlet—it's a fire hazard.

Power Supply Unit (PSU): Most miners don't include one. You need a high-quality, 240V, 1600W+ PSU from a brand like Bitmain's APW series or Parallel Miner. Budget $200-$400.

Cooling and Ventilation: An ASIC exhausts massive amounts of heat. In a small room, temperatures can hit over 100°F (38°C) quickly. You need industrial fans, ducting to vent heat outside, or a dedicated, well-ventilated space (like a garage or basement). In summer, this might require additional AC, which itself consumes expensive power.

Noise: This isn't a gentle hum. We're talking 75-85 decibels—as loud as a vacuum cleaner running constantly. You cannot run this in a living space. Soundproofing boxes or remote hosting are additional costs.

Internet: A stable, low-latency connection is crucial. Mining pools penalize high latency, which can reduce your effective earnings.

Your Step-by-Step Mining Process

Let's walk through setting up a single Antminer S19j Pro, assuming you have the power and space ready.

1. Source Your Hardware: Buy from an authorized distributor or a highly-rated seller on a platform like eBay. Check seller reviews meticulously. New units have a warranty; used ones are a gamble.

2. Assemble the Basics: Connect the PSU to the miner's hash boards. Plug in the network cable. This part is surprisingly simple—it's all proprietary connectors that only fit one way.

3. Configure the Miner: Find your miner's IP address on your router. Type it into a web browser. This opens the built-in interface (like a router's admin page). Here, you set your mining pool details and your worker name.

4. Choose a Mining Pool: This is critical. You're joining a team. Popular pools include Foundry USA, Antpool, ViaBTC, and F2Pool. Compare their fee structure (usually 1-2%), payout schemes (PPS+, FPPS), and minimum payout thresholds. Don't just pick the biggest pool; smaller pools can offer more consistent payouts for small miners. I started with Slush Pool for their transparent score-based system.

5. Create a Worker: On your pool's website, create an account and then set up a "worker" (e.g., yourusername.worker1). Enter this worker name and the pool's URL/port into your miner's configuration page.

6. Power Up and Monitor: Flip the switch. The fan roar will tell you it's alive. Monitor the miner's status page and your pool's dashboard. It will take some time (up to an hour) for shares to be submitted and your hash rate to show up on the pool.

7. Set Up a Wallet: You need a Bitcoin wallet to receive payouts. For security, use a non-custodial wallet like a hardware wallet (Ledger, Trezor) for storing rewards. The pool will send payouts to the wallet address you provide in your account settings.

The Only Profitability Calculation That Matters

Never trust a website's "daily profit" estimate at face value. They use average electricity costs and ignore your local reality. Do this yourself.

Use a detailed calculator like the one from NiceHash or CryptoCompare. Input your exact numbers:

- Hash Rate: From your miner's specs (e.g., 100 TH/s).

- Power Consumption: In watts (e.g., 3250W).

- Cost per kWh: Find this on your utility bill. This is the most critical variable. In the US, it varies from $0.05 (Washington) to over $0.30 (California, Hawaii).

- Pool Fees: Typically 1-2%.

- Bitcoin Price: Use a conservative estimate.

The formula in your head is simple: (Daily Bitcoin Earned × Bitcoin Price) − (Daily kWh Used × Cost per kWh).

If the result is negative, you're losing money. The machine is converting expensive electricity into less-valuable bitcoin. Here's a brutal truth: if your electricity cost is above $0.12/kWh, it's incredibly difficult to profit with even the most efficient ASIC after the 2024 halving, unless the BTC price rises dramatically.

Common Pitfalls and How to Avoid Them

Pitfall 1: Ignoring Noise and Heat. You think, "I'll put it in the spare room." Within a day, you'll move it. Plan for a permanent, isolated location from the start.

Pitfall 2: Underestimating Electrical Demands. Daisy-chaining power strips or using undersized wiring causes voltage drops, reduces hash rate, and risks fire. Hire an electrician if you're unsure.

Pitfall 3: Chasing the Latest Hardware. The newest ASIC has the best efficiency but also the highest price premium. Often, a previous-generation model on sale offers a better return on investment (ROI) timeframe.

Pitfall 4: Not Monitoring Remotely. Miners can freeze, disconnect, or hash at lower rates. Use monitoring software like Hive OS (for multiple miners) or your pool's alert system to get notifications if your worker goes offline.

Pitfall 5: Treating It as Passive Income. It's not. It's active asset management. You must track bitcoin price, network difficulty (which always goes up over time), and electricity costs constantly. You need an exit plan for if mining turns unprofitable.