Let's get straight to it. A liability is any money you owe—now or later. It's not just debt; it's a financial obligation that can make or break your wallet or business. Most people think of loans, but it's broader: unpaid bills, future taxes, even promises like warranties. I've spent years advising clients, and the biggest mistake is treating liabilities as abstract accounting terms. They're real, and they bite if ignored.

Quick Navigation: What You'll Learn

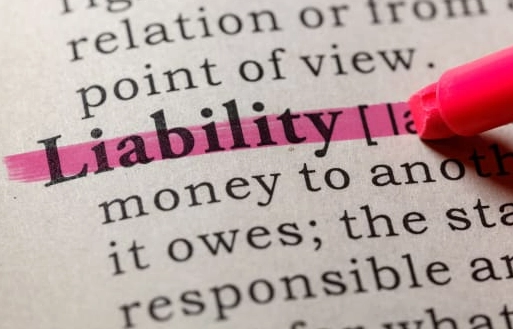

What Exactly is a Liability? Breaking Down the Basics

In simple terms, a liability is something you're on the hook to pay. Think of it as an IOU. The Financial Accounting Standards Board (FASB) defines it as a present obligation from past events, expected to cause an outflow of resources. But that's jargon. Here's what it means for you.

Say you buy a laptop on credit. You get the laptop now, but you owe the store money later. That's a liability. Or a business takes out a loan to expand—the loan is a liability until repaid. It's not inherently bad; it's a tool. Used wisely, it fuels growth. Used poorly, it drags you down.

The Accounting Definition vs. Real Life

Accountants love categories. Liabilities go on the balance sheet under "liabilities and equity." They're split into current (due within a year) and long-term (due later). But in real life, it's messier. I worked with a freelancer who forgot her tax liabilities—she spent all her income, then got hit with a huge bill. That's a liability she overlooked.

Real-life examples:

- Credit card debt: You swipe, you owe. Interest piles up fast.

- Mortgage: A long-term liability that builds equity if managed.

- Business accounts payable: Unpaid invoices to suppliers.

- Accrued expenses: Wages you owe employees for work done but not yet paid.

See the pattern? It's about future cash outflows. If you promise to pay, it's likely a liability.

The Different Types of Liabilities You Need to Know

Not all liabilities are created equal. Mixing them up can lead to financial blunders. Here's a breakdown I use in workshops.

| Type | Description | Example | Why It Matters |

|---|---|---|---|

| Current Liabilities | Due within 12 months | Credit card balance, rent due | Impacts short-term cash flow; miss payments, and credit score tanks. |

| Long-Term Liabilities | Due after 1 year | Mortgage, business loans | Affects long-term solvency; high levels can scare investors. |

| Contingent Liabilities | Potential obligations | Lawsuits, product warranties | Hidden risks; often ignored until crisis hits. |

| Secured vs. Unsecured | Backed by collateral or not | Car loan (secured), personal loan (unsecured) | Secured ones have lower interest but risk asset loss. |

Current liabilities are the urgent ones. I've seen businesses focus on long-term debt while ignoring overdue bills—vendors cut supplies, operations halt. Prioritize by due date.

Contingent Liabilities: The Hidden Dangers

These are the sneaky ones. They depend on future events. A company might face a lawsuit; if they lose, they pay. Until then, it's a contingent liability. Many small businesses don't list these, thinking "it won't happen." Bad move. During an audit for a tech startup, I found an undisclosed software licensing dispute. It became a real liability overnight, shocking their investors.

Always assess contingents. Ask: What could go wrong? Warranty claims, environmental clean-ups, even employee disputes. Document them in financial notes, as per International Financial Reporting Standards (IFRS) guidelines.

How Liabilities Impact Your Financial Health

Liabilities aren't just numbers on paper. They shape your financial destiny. Let's talk impact.

For individuals, high liabilities mean less disposable income. You're working to pay off past purchases instead of saving for the future. I had a client with $30,000 in credit card debt—her interest payments alone were $500 a month. That's money not going into retirement or emergencies.

For businesses, liabilities affect everything. They influence:

- Credit ratings: Agencies like Moody's look at liability ratios. Too high, and borrowing costs soar.

- Investor confidence: High long-term debt can signal risk, scaring away venture capital.

- Operational flexibility: Cash tied up in repayments limits growth opportunities.

Case Study: A Small Business Liability Scenario

Imagine "Bella's Bakery." Bella takes a $50,000 loan for new ovens (long-term liability). Sales jump, but she also racks up $10,000 in supplier bills (current liabilities). She ignores the bills, focusing on the loan. Suppliers stop deliveries, production stalls. Suddenly, she can't make loan payments either. The bakery closes within months.

What went wrong? Misprioritization. Current liabilities choked cash flow. Lesson: Balance both. Use tools like the current ratio (current assets / current liabilities). Aim for above 1.5 to stay safe. Bella's was 0.8—a red flag.

Personal finance isn't different. Your debt-to-income ratio should stay below 36%, as recommended by many financial advisors. Exceed that, and mortgages get denied.

Practical Steps to Manage and Reduce Liabilities

Managing liabilities isn't rocket science, but it requires discipline. Here's a step-by-step approach I've refined over years.

Step 1: Assess Your Current Liabilities

List everything you owe. Yes, everything. Include that forgotten gym membership fee. Use a spreadsheet or an app. Categorize by type, interest rate, and due date. For businesses, pull balance sheet data. I once helped a retailer discover $5,000 in unpaid utility bills buried in paperwork—saved them from a service cut-off.

Step 2: Prioritize Repayment

Focus on high-interest liabilities first. Credit cards often have 20%+ rates; pay those down aggressively. For low-interest ones like some mortgages, minimum payments might suffice if you're investing elsewhere. But don't neglect them.

A strategy: The avalanche method. Pay extra on the highest interest debt while making minimums on others. It saves more on interest than the snowball method (paying smallest debts first).

Step 3: Negotiate with Creditors

Most people don't try this. Creditors might lower interest rates or offer payment plans. I've seen credit card companies reduce rates by 5% just for asking. For businesses, talk to suppliers about extended terms. It turns a current liability into a more manageable one.

Step 4: Build a Safety Net

Set aside cash for unexpected liabilities. An emergency fund covers 3-6 months of expenses. It prevents new debt when surprises hit—like a car repair or a tax bill.

For companies, maintain a cash reserve. It buffers against contingent liabilities materializing. Refer to U.S. Securities and Exchange Commission (SEC) reports for examples of how public companies disclose reserves.

Common Mistakes People Make with Liabilities

Here's where experience talks. I've spotted patterns that lead to trouble.

Mistake 1: Treating All Debt as Equal. A mortgage at 3% isn't the same as a payday loan at 300%. Yet, I've seen folks pay off their mortgage early while ignoring credit card debt. The math doesn't lie: tackle high-cost liabilities first.

Mistake 2: Ignoring Contingent Liabilities. As mentioned, they're invisible until they're not. A friend's business faced a warranty claim on a faulty product—no reserve, so they took a high-interest loan to cover it. Always estimate and disclose these.

Mistake 3: Overleveraging for Growth. Liabilities can fuel expansion, but too much is dangerous. A tech startup I consulted for took multiple loans to scale fast; when market dipped, repayments drowned them. Keep debt-to-equity ratio below 2:1 for stability.

Mistake 4: Not Reviewing Regularly. Liabilities change. Interest rates adjust, new debts emerge. Review quarterly. Set a calendar reminder. It sounds basic, but most don't do it.

My take: Liabilities are like fire—useful if controlled, destructive if not. Respect them, don't fear them.