In This Guide

- What Are Fixed Costs? (No Jargon, I Promise)

- Why Bother? The Real-World Impact of Fixed Costs

- Fixed Costs vs. Variable Costs: The Eternal Dance

- A Rundown of Common Fixed Costs (The Usual Suspects)

- How to Actually Calculate Your Total Fixed Costs

- Strategies for Managing and Optimizing Fixed Costs

- Common Fixed Cost Pitfalls and Misconceptions

- Fixed Costs FAQs: Answering Your Burning Questions

Let's talk about the bills that show up every single month, rain or shine, whether you had a record-breaking sales month or a total dud. You know the ones I mean – the rent, the insurance, the software subscriptions. That's your fixed costs in action. They're the bedrock of your business's financial structure, and honestly, getting a handle on them is one of the most powerful things you can do as a business owner. It's not the sexiest topic, I'll give you that. But understanding fixed costs is the difference between flying blind and having a financial dashboard that actually tells you something useful.

I remember when I first started out, I lumped everything together. Money went out, money came in. It was chaos. It wasn't until I sat down and forced myself to separate the predictable, steady fixed costs from the wild, fluctuating variable ones that the picture started to clear. Suddenly, I knew exactly how much I needed to make just to keep the lights on. That number – your break-even point – is built on the foundation of your fixed expenses.

What Are Fixed Costs? (No Jargon, I Promise)

In the simplest terms, fixed costs are business expenses that remain constant in total amount, regardless of how much you produce or sell. Your output could be zero, or you could be working at maximum capacity – these costs don't budge. They're the non-negotiables of your monthly overhead.

The key characteristic here is total amount. Your monthly rent is $2,000 whether you make 10 units or 10,000. That's a classic fixed cost. Now, on a per-unit basis, these costs do change. If you only make 10 units, that rent adds $200 to the cost of each one. Make 10,000 units, and it's just 20 cents per unit. This per-unit cost fluctuation is crucial for understanding pricing and profitability.

The Core Features of a True Fixed Cost

- Time-Based: They are typically incurred over a specific period – monthly, quarterly, or annually. You pay for the time (a month of rent) or the access (an annual software license), not for usage.

- Contractual or Committed: Most are locked in by agreements – leases, service contracts, salary agreements. You can't just cancel them on a whim without penalties.

- Predictable: This is their superpower for budgeting. You know, with high certainty, what these numbers will be next month.

- Independence from Volume: This is the golden rule. The total dollar amount does not dance to the tune of your sales volume.

Why Bother? The Real-World Impact of Fixed Costs

You might be thinking, "Okay, they're predictable. So what?" Well, these costs quietly dictate some of your most important business decisions.

First, they determine your break-even point. This is the sales volume you need to cover ALL your costs (fixed and variable) before you make a single cent of profit. The formula is simple but powerful: Break-Even Point (in units) = Total Fixed Costs / (Selling Price per Unit - Variable Cost per Unit). The higher your fixed costs, the more you need to sell just to reach zero. It's a higher mountain to climb every month.

Second, they directly influence your pricing strategy. You can't just price based on materials and labor. You have to bake a slice of your fixed overhead into the price of every item or service you sell. Ignore this, and you'll be "busy" but broke.

Third, they are the primary driver of operating leverage. This is a fancy term for a simple concept: a business with high fixed costs and low variable costs sees profit explode once it passes the break-even point. Think of a software company. Huge upfront development costs (fixed), but then each additional customer costs almost nothing. The flip side? If sales dip below that point, losses pile up just as quickly. It's a high-risk, high-reward structure.

Finally, they are the bedrock of your cash flow planning. Knowing exactly what's due and when allows you to manage cash reserves effectively. A missed fixed cost payment (like insurance) can have catastrophic consequences far worse than skipping a variable supply order.

Fixed Costs vs. Variable Costs: The Eternal Dance

You can't understand one without the other. They're the yin and yang of your cost structure. Let's make it crystal clear with a head-to-head comparison.

| Aspect | Fixed Costs | Variable Costs |

|---|---|---|

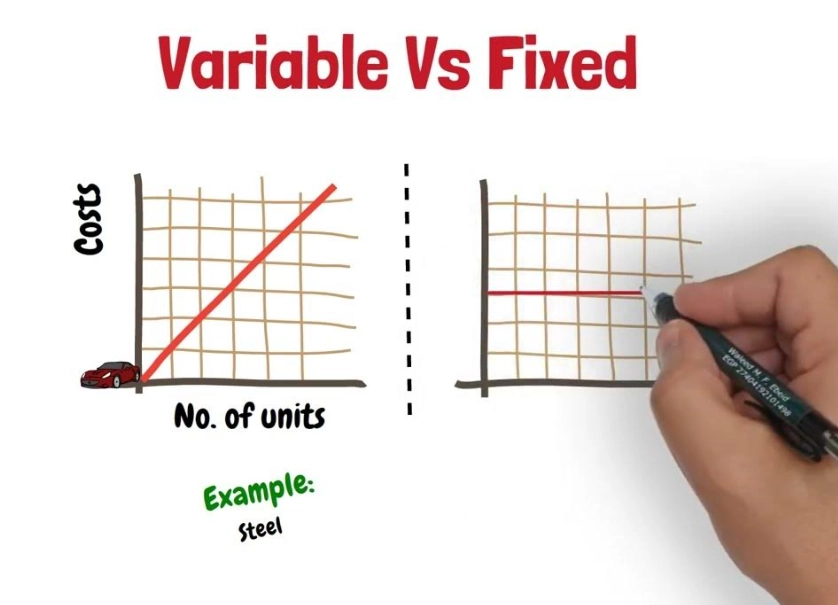

| Definition | Costs that remain constant in total over a relevant range of activity. | Costs that change in total directly and proportionally with the level of activity. |

| Behavior | Total cost stays flat. Per-unit cost decreases as production increases. | Total cost rises with production. Per-unit cost generally stays constant. |

| Examples | Rent, salaries, insurance, depreciation, property taxes, annual software licenses. | Raw materials, direct labor (if hourly/piece-rate), sales commissions, shipping costs, credit card processing fees. |

| Predictability | Highly predictable for budgeting. | Less predictable, tied directly to sales volume. |

| Control & Timing | Often committed long-term. Hard to adjust quickly. | Easier to adjust in the short term (order less supplies, reduce hourly staff). |

| Impact on Risk | Higher fixed costs generally mean higher operating leverage and higher financial risk if sales fall. | Higher variable costs mean lower operating leverage and lower risk if sales fall. |

Most businesses also have mixed or semi-variable costs. These have both a fixed and a variable component. A classic example is a utility bill: you have a base connection charge (fixed) plus a charge for each unit of consumption (variable). A salesperson might have a base salary (fixed) plus commission (variable). It's important to try and split these out for accurate analysis.

A Rundown of Common Fixed Costs (The Usual Suspects)

Let's get practical. Here’s a list of typical fixed business costs you'll encounter across different types of businesses. This isn't exhaustive, but it covers the big hitters.

Overhead & Occupancy Costs

- Rent or Mortgage Payments: The big one for brick-and-mortar businesses.

- Property Taxes: Often rolled into a mortgage payment or paid separately.

- Building Insurance: Required for most commercial leases and loans.

- Utilities (Base Charges): The minimum monthly fees for water, sewer, gas, and electricity before usage.

- Security & Alarm Monitoring: Monthly service fees.

Administrative & Personnel Costs

- Salaries for Administrative Staff: Office manager, accountant, etc. – their pay isn't tied to production.

- Employer-Portion of Payroll Taxes: A percentage of salaries, so it's fixed if salaries are fixed.

- Employee Benefits (Health Insurance, Retirement Contributions): Often a fixed cost per employee per month.

- Professional Fees: Retainers for lawyers, accountants, or consultants on a fixed monthly fee.

Technology & Operational Costs

- Software Subscriptions (SaaS): Monthly or annual fees for tools like CRM, accounting software, project management, email marketing, etc. This is a massive and growing category of fixed costs for modern businesses.

- Website Hosting & Domain Renewals: Annual fees that are easy to forget.

- Equipment Leases: Payments for leased copiers, vehicles, or machinery.

- Depreciation: This is a non-cash fixed cost. It's the systematic allocation of the cost of a tangible asset (like a delivery van or a machine) over its useful life. It shows up on your income statement and reduces profit, even though no cash left your bank account this month for it.

See what I mean? They're everywhere. The goal isn't to eliminate them – that's impossible. The goal is to optimize them.

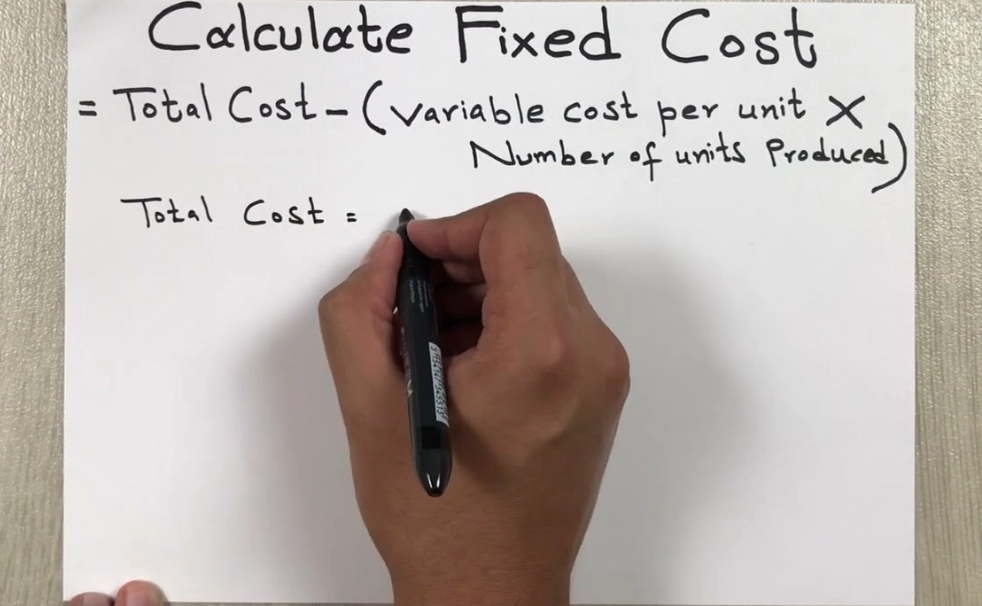

How to Actually Calculate Your Total Fixed Costs

This isn't rocket science, but it does require some digging. Don't just guess.

- Gather Your Financial Statements: Pull out your profit and loss statement (income statement) from the last few months. Look at your bank and credit card statements.

- Go Line by Line: For every single expense, ask: "Does the TOTAL amount of this bill change if I sell more or less?" If the answer is "No," or "Not really, it's about the same every month," flag it.

- Watch for Annual/Quarterly Bills: Don't just look at monthly statements. You need to annualize costs like insurance paid yearly or property taxes paid bi-annually. Add up all these periodic fixed costs for the year and divide by 12 to get a true monthly average. Missing this step is a classic budgeting mistake.

- Separate Mixed Costs: For bills like a phone plan with a base fee + overage, or a sales salary + commission, estimate the fixed portion. Sometimes you have to call the provider or analyze past bills to find the pattern.

- Add It All Up: Sum the monthly total of all these flagged expenses. That’s your monthly fixed overhead. This is your magic number.

Once you have that number, you can start playing with the break-even formula I mentioned earlier. It’s eye-opening.

Strategies for Managing and Optimizing Fixed Costs

Okay, you've identified them. Now, how do you wrestle them into submission? You don't just accept them as fate. Here are actionable strategies, from easy wins to deeper strategic moves.

1. The Regular Audit (The "Subscription Purge")

Do this quarterly. Go through every software subscription and recurring service. Are you using it? Is it at the right tier? Can you get a comparable tool for less? I've found hundreds of dollars a month in "zombie" subscriptions that departments forgot about. It's the lowest-hanging fruit.

2. Renegotiate Everything

Your fixed costs are not set in stone when contracts come up for renewal. Rent, insurance, internet service, software licenses – everything is negotiable. Come prepared with competitor quotes. For something like commercial rent, resources from the U.S. Small Business Administration guide on choosing a location can give you leverage by showing market rates. Loyalty rarely gets you a discount; a willingness to walk often does.

3. Embrace the Hybrid/Flexible Model

Do you really need that 5,000 sq. ft. office? The pandemic proved a lot of work can be done remotely. Consider downsizing to a smaller space, a co-working membership, or going fully remote to slash the biggest fixed cost for many businesses. This is a major strategic shift, but the savings can be transformative.

4. Outsource to Convert Fixed to Variable

This is a powerful lever. Instead of hiring a full-time, salaried employee (a high fixed cost), can you use a freelancer, agency, or part-time contractor for that role? You pay for the work you need, when you need it. This turns a fixed personnel cost into a variable one. It's not right for every role (core leadership should probably be fixed), but it's perfect for specialized, project-based work.

5. Invest in Efficiency

Sometimes, spending money saves more money. Upgrading to more energy-efficient lighting or HVAC is an upfront cost that lowers your monthly utility base fees (a fixed cost) for years. Buying a critical piece of equipment instead of leasing it removes a monthly lease payment, though it adds depreciation. Run the numbers on the long-term payoff.

Common Fixed Cost Pitfalls and Misconceptions

Let's bust some myths. I've believed a few of these myself over the years.

Myth 1: "Fixed Costs are always fixed." Nope. They are fixed only within a "relevant range" of activity. If your business doubles, you might outgrow your space and need a second warehouse (rent jumps). Your "fixed" cost just took a step up. They're fixed until they're not.

Myth 2: "Depreciation isn't a real cost." It's a non-cash expense, but it's very real on your income statement. It represents the using up of a valuable asset you already paid for. Ignoring it makes your profit look better than it is and messes up your pricing.

Myth 3: "Lower fixed costs are always better." Not necessarily. As discussed, high fixed costs can create immense profitability (operating leverage) after the break-even point. A capital-intensive manufacturer has high fixed costs but can produce at a very low per-unit cost. The goal is the right structure for your business model and risk tolerance.

Myth 4: "I can ignore them when making short-term decisions." This is the most dangerous one. For a one-time, special order, fixed costs are often irrelevant (they'll be paid anyway). But for any decision that affects your overall capacity or long-term structure, fixed costs are the star of the show. Thinking about launching a new product line? You'd better believe the additional fixed costs for marketing, staff, or space need to be in the forecast.

Fixed Costs FAQs: Answering Your Burning Questions

Can fixed costs ever become variable?

Absolutely, through conscious strategy. The outsourcing example above is a prime method. Moving from a salaried in-house team to a contracted agency converts that fixed payroll into a variable project cost. Technology is also enabling this shift – think cloud computing (pay for server capacity as you use it) vs. buying your own servers (a huge fixed depreciation cost).

How do I budget for fixed costs that increase annually?

Don't budget based on last year's number. Look at your contracts. Does your lease have a 3% annual escalator? Does your software subscription typically go up 10% upon renewal? Build those increases into your forward-looking budget. Call providers and ask about expected rate changes. A budget based on historical data alone is a budget for surprise shortfalls.

Are loan payments a fixed cost?

The interest portion of a loan payment is a fixed financing cost (it's on your income statement). The principal repayment portion is not an expense; it's a balance sheet transaction (reducing a liability). However, for pure cash flow planning, the total monthly loan payment is a fixed cash outflow you must account for. For profitability analysis, you only care about the interest.

What's a good ratio of fixed to variable costs?

There's no universal "good" ratio. It depends entirely on your industry and model. A consulting firm will have very high variable costs (consultant labor tied to projects) and low fixed costs. A software company is the opposite. The key is to know your industry's norm and understand the risk/reward profile your ratio creates. Resources like industry reports from IMA (Institute of Management Accountants) can provide benchmarking data for different sectors.

Look, at the end of the day, mastering your fixed costs isn't about accounting theory. It's about gaining control. It's about knowing the exact ground level from which your business builds its profits each month. It's about making strategic decisions from a position of knowledge, not fear or guesswork.

Start simple. This weekend, take an hour, pull up your bank statements, and make that list. Add up your monthly fixed overhead. I bet you'll be surprised by the total, and I guarantee you'll instantly spot one or two costs you can question, renegotiate, or eliminate. That's the first step toward turning your fixed costs from a silent burden into a managed foundation for growth.