In This Article

- Why a Warranty Deed is the Homebuyer's Best Friend

- The Six Covenants: The Heart of the Warranty Deed

- Warranty Deed vs. Quitclaim Deed

- What Does a Warranty Deed Look Like?

- The Step-by-Step Journey of a Warranty Deed

- Common Questions & Concerns

- Potential Pitfalls & How to Avoid Them

- The Bottom Line: Is a Warranty Deed Worth It?

If you're buying a house, you'll hear the term "warranty deed" thrown around a lot. Lawyers and agents toss it out like it's common knowledge. But let's be honest, when you're in the thick of the home-buying chaos, the last thing you want is to nod along pretending you get it. You deserve to know exactly what you're signing and what it means for your biggest investment.

I remember sitting at my own closing, staring at a stack of papers. The warranty deed was in there somewhere. I signed it because everyone said to, but the nagging feeling of not fully understanding it stuck with me. That's why we're going to break this down, without the jargon.

In plain English, a warranty deed is a legal document used to transfer ownership of real estate (like a house or land). But it's not just any document—it's the one that comes with the seller's strongest possible promises, or "covenants," about the property's history and their right to sell it. Think of it as the seller giving you a robust guarantee, not just handing you the keys.

The Core Idea: When you receive a warranty deed, the seller (the grantor) is legally warranting, or guaranteeing, several key facts about the property to you (the grantee). If any of those guarantees turn out to be false, you can sue the seller for damages. That's a powerful shield most other deeds don't provide.

Why a Warranty Deed is the Homebuyer's Best Friend (Most of the Time)

You might wonder if all this is just legal theater. It's not. The promises in a warranty deed tackle the hidden nightmares of real estate: unknown liens, shady past ownership, or claims from a long-lost heir. These are the things title insurance also protects against, but the warranty deed gives you a second line of defense—a person or entity to hold accountable.

It forces the seller to stand behind the sale. In a way, it's a sign of a confident, above-board transaction. If a seller refuses to give a warranty deed and insists on something weaker, that's a huge red flag. It makes you ask, "What do you know about this property that you don't want to be on the hook for?"

Now, let's get into the nitty-gritty of those promises. They're not just one vague assurance; they're a set of specific, time-tested legal covenants.

The Six Covenants: The Heart of the Warranty Deed

This is where understanding what a warranty deed is gets practical. These covenants are its superpower. They are often split into two groups: present covenants (which are breached, if at all, at the moment of sale) and future covenants (which can be breached later on).

| Covenant | What It Means (In Plain English) | When It's Breached | Why It Matters to You |

|---|---|---|---|

| Covenant of Seisin | The seller swears they actually own the property and have the legal right to convey it. | At closing (Present) | Prevents you from buying from a fraudster or someone who only owns half the property. |

| Covenant of Right to Convey | Similar to seisin, but specifically means the seller has the authority to transfer title. | At closing (Present) | Another layer of assurance on their legal authority. |

| Covenant Against Encumbrances | The seller promises there are no hidden liens, mortgages, or easements (except those already disclosed). | At closing (Present) | Protects you from surprise debts attached to the property, like an old contractor's lien. |

| Covenant of Quiet Enjoyment | The seller guarantees you won't be kicked out or disturbed by someone with a superior legal claim. | In the Future | Your peace-of-mind promise. If a true owner emerges, you have recourse against the seller. |

| Covenant of Warranty | The seller pledges to defend your title against any lawful claims and cover related costs. | In the Future | This is the "warranty" in warranty deed. They'll back you up in court if needed. |

| Covenant of Further Assurance | The seller promises to sign any extra documents needed to perfect your title down the road. | In the Future | A practical promise to help clean up minor title issues that pop up later. |

See? It's comprehensive. The first three cover the state of things right now at closing. The last three are the seller's ongoing insurance policy for you in the future. That future protection is what makes a general warranty deed so strong.

Oh, and a quick note: You might hear about "general" vs. "special" warranty deeds. A general warranty deed covers the entire history of the property. A special warranty deed only covers the time the seller owned it. You want the general one. Special warranty deeds are common from banks or corporations (like after a foreclosure) who can't vouch for previous owners. It's decent protection, but not the gold standard.

Warranty Deed vs. Quitclaim Deed: The Showdown You Need to Understand

This is the most common point of confusion, and frankly, where people can get burned. If you only learn one comparison, make it this one.

A quitclaim deed is like saying, "Hey, whatever interest I might have in this property, I'm giving it to you. No promises." It offers zero warranties. None. Zilch.

Let me give you a personal example. I once helped a family member add their spouse to the title of their home. We used a quitclaim deed. Why? Because it was a transfer of ownership between trusted parties where guaranteeing the title's history was unnecessary. It was fast, cheap, and fit the purpose.

Critical Warning: You should almost never accept a quitclaim deed from a seller in an arm's-length purchase (a standard sale between unrelated parties). If a seller offers you a quitclaim deed instead of a warranty deed, run. It's a major red flag that they either know of a title problem or want to avoid liability for one. A warranty deed is the expectation in nearly all standard home purchases.

Here’s a quick mental checklist:

- Use a Warranty Deed for: Buying a house, selling to a non-family member, any transaction where money changes hands and you want guarantees.

- Use a Quitclaim Deed for: Adding/removing a spouse, transferring property into a trust, gifting property within a family, clearing up a minor title defect between cooperating parties.

The difference couldn't be starker. One protects you, the other exposes you.

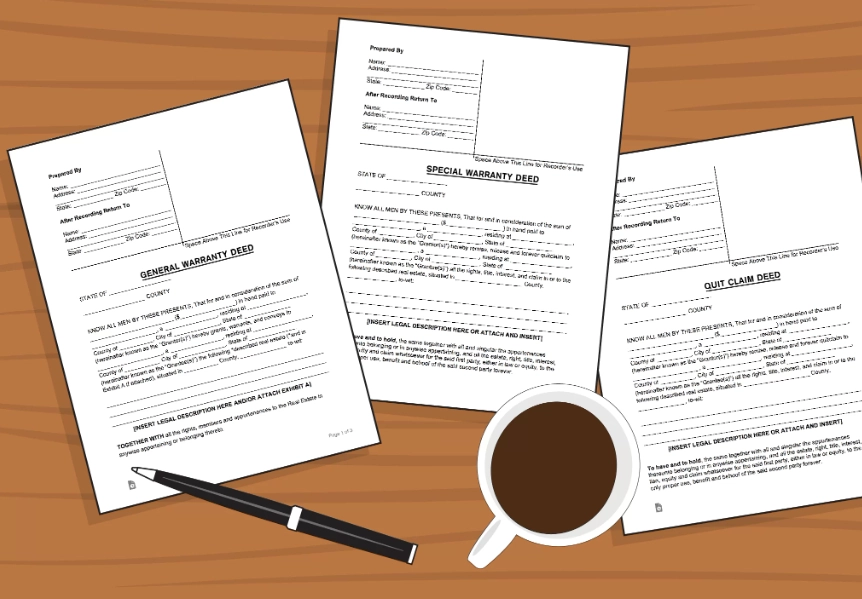

What Does a Warranty Deed Look Like? Breaking Down a Real Example

Knowing what is a warranty deed on paper helps demystify it. While formats vary by state, they all contain key elements. Let's walk through a simplified version.

WARRANTY DEED

THIS INDENTURE, made this [Date], between [Seller's Full Name], with an address of [Seller's Address] (the "Grantor"), and [Buyer's Full Name], with an address of [Buyer's Address] (the "Grantee").

WITNESSETH, that the Grantor, for and in consideration of the sum of [Purchase Price] Dollars and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, does hereby GRANT, BARGAIN, SELL, AND CONVEY unto the Grantee, their heirs and assigns forever, all that certain piece of property described as follows:

[Legal Description of the Property – This is NOT the street address. It's a precise metes-and-bounds or lot/block description from a survey.]

TOGETHER with all improvements, easements, and appurtenances belonging thereto.

TO HAVE AND TO HOLD the same unto the Grantee forever.

And the Grantor hereby covenants with the Grantee that the Grantor is lawfully seized of the premises in fee simple; that the premises are free from all encumbrances, except as noted herein; that the Grantor has good right to sell and convey the same; and that the Grantor will WARRANT AND DEFEND the title to the premises unto the Grantee against the lawful claims of all persons whomsoever.

IN WITNESS WHEREOF, the Grantor has executed this deed on the date first above written.

[Signature of Seller(s)]

[Notary Acknowledgment Seal and Signature]

See the magic words? "Grantor hereby covenants..." and "will WARRANT AND DEFEND the title..." That's the enforceable promise. That's what makes it a warranty deed and not something else. The legal description is also crucial—it's the property's fingerprint. A mistake here can cause massive headaches.

The Step-by-Step Journey of a Warranty Deed

How does this piece of paper actually work in your transaction?

- Preparation: Your title company or attorney drafts the deed based on the sales contract, ensuring names and the legal description are perfect.

- Signing: At closing, the seller(s) sign it in front of a notary public. The buyer does not sign the deed.

- Recording: After closing, the deed is sent to the county recorder's office (or similar local office). A clerk files it, stamps it with a book and page number, and it becomes part of the public record. This step is non-negotiable. An unrecorded deed is practically worthless if a dispute arises.

Recording is what tells the world you're the new owner. It's the final, essential step that locks in your ownership and the seller's warranties.

Common Questions & Concerns (The Stuff That Keeps Buyers Up at Night)

Let's tackle some real-world questions I've heard from anxious buyers.

If I have title insurance, do I even need a warranty deed?

Yes, absolutely. Think of them as a team. The warranty deed is your contractual promise from the seller. Title insurance is a financial backstop from an insurance company. If a title problem arises, you'd typically file a claim with your title insurer first. But if the insurer has to pay out, they may then use their "subrogation" rights to turn around and sue the seller based on the warranties in the deed to recover their money. The deed strengthens the overall chain of protection. For a deeper dive on how title insurance works, the American Land Title Association (ALTA) is the industry's premier source of consumer information.

Can I sue a seller years later based on the warranty deed?

For the future covenants (like Quiet Enjoyment and Warranty), yes, you generally can. The statute of limitations for breaching these covenants often starts from the date the problem is discovered, not the sale date. This is why that long-term guarantee matters. For the present covenants, the clock usually starts ticking at closing.

What if the seller is a trust or an LLC?

The principle is the same. The entity (the trust, the LLC) becomes the "Grantor" and makes the warranties. However, collecting on a warranty from a shell LLC with no assets can be tricky. This is another reason why title insurance is critical—the insurer is a stable, regulated company.

How do I check if my deed was recorded correctly?

A few weeks after closing, you can contact your county recorder's office. Many have online search portals. You can search by your name or the property address. Your closing agent or title company should also provide you with a copy of the recorded deed. Keep it with your most important documents—forever. You can often find guidance on your specific county's process on your state or county's official government website.

Potential Pitfalls & How to Avoid Them

Even with a warranty deed, things can go sideways if you're not careful.

- Typos and Errors: A misspelled name or an incorrect legal description can render the deed defective. Always have a professional (title company or real estate attorney) prepare it.

- Improper Execution: If the seller's signature isn't notarized, or if a required spouse doesn't sign, the deed may be invalid. The closing agent's job is to catch this.

- Undisclosed Heirs or Spouses: This is a classic title nightmare. A warranty deed protects you if this emerges, but the legal fight is still stressful. A thorough title search before closing is your first defense.

- Thinking the Deed Proves You Paid: It doesn't. The deed shows ownership transfer, not that the mortgage is paid. That's tracked separately by your lender and released via a separate "satisfaction" document.

My biggest piece of advice? Don't treat the deed as a trivial formality. It's the foundational document of your ownership. Ask questions. Make sure you understand what you're getting.

The Bottom Line: Is a Warranty Deed Worth It?

Without a doubt. In a standard home purchase, it's not even a question—it's the default, and you should insist on it. The cost to the seller is negligible (just a slightly different form), but the protection for you is monumental.

Understanding what a warranty deed is empowers you. It turns a mysterious legal document into a known quantity—a powerful tool in your pocket that guarantees the seller stands behind their sale. It works hand-in-hand with title insurance to give you the most secure foundation possible for your new home.

When you finally get that copy of the recorded deed in the mail, you'll see it not just as a piece of paper, but as a signed promise. And that makes all the difference.