Let's be honest. The term "investment advice" is everywhere, and most of it is useless noise. You've got the talking heads on TV shouting about the next hot stock, social media gurus promising secret strategies, and a mountain of blogs repeating the same basic tips. It's enough to make anyone just stick their money in a savings account and forget about it.

I learned this the hard way. Early in my career, I followed generic advice to "diversify" and ended up with a messy collection of a dozen mutual funds with overlapping holdings and high fees. I was diversified on paper, but my returns were mediocre, and I had no idea why. Good investment advice isn't about giving you a fish; it's about teaching you to fish in your pond, with your gear, for your dinner.

Real, actionable investment advice does three things: it aligns with your specific financial life (not a generic profile), it's transparent about costs and conflicts, and it gives you a framework to make decisions even when markets are chaotic. That's what we're going to build here.

Your Roadmap to Smarter Investing

What Investment Advice Actually Is (Hint: It's Not Stock Picks)

If you think investment advice is about someone telling you to buy Tesla or Bitcoin, you're setting yourself up for disappointment. That's speculation, not advice. True investment advice is a process, not a product.

Think of it as a personalized operating system for your money. It answers questions like:

- How much of my income should go to investing vs. building an emergency fund?

- Given my 30-year timeline, what's an appropriate mix of stocks and bonds that I can actually stick with during a 20% market drop?

- I have a 401(k), an old IRA, and a brokerage account. How do I coordinate them so they work together tax-efficiently?

- How do I turn my investments into a reliable paycheck when I retire?

The core of this advice is asset allocation and behavioral coaching. A Vanguard study quantified this, finding that a sound financial plan and behavioral guidance are responsible for a significant portion of an investor's potential net returns. The specific funds you pick matter far less than most people think.

How to Find a Financial Advisor You Won't Regret

Hiring a professional can be a game-changer, but the industry is a minefield of confusing titles and hidden fees. You need to know what to look for.

First, understand how they get paid. This is the single biggest predictor of the advice you'll get.

| Advisor Type | How They're Paid | Biggest Pro | Biggest Con / Conflict |

|---|---|---|---|

| Fee-Only Fiduciary (CFP® recommended) | Hourly rate, flat project fee, or percentage of assets you manage (AUM fee). No commissions. | Legally must put your interests first (fiduciary duty). Transparency. | AUM fees can get expensive on very large portfolios. You must vet their investment philosophy. |

| Commission-Based Broker | Earns a sales commission on products they sell you (funds, insurance, annuities). | May have no minimum asset requirement. | Major conflict of interest. They are often not fiduciaries. May recommend products that pay them more, not you better. |

| Robo-Advisor (e.g., Betterment, Wealthfront) | Low annual AUM fee (around 0.25%). | Low cost, automated, great for simple portfolios and tax-loss harvesting. | No human for complex planning (estate, tax, stock options). One-size-fits-most approach. |

My non-consensus take? Don't get hung up on the "fiduciary" label alone. It's a crucial floor, not the ceiling. A fee-only fiduciary could still give you lousy, expensive advice if they put you in high-cost active funds to boost their own revenue. You need to ask the next layer of questions: "What is your typical portfolio construction? Do you use primarily low-cost index funds? Can you show me a sample plan?"

Questions to Ask in a First Meeting

This meeting is you interviewing them. Come prepared.

- "Are you a fiduciary, 100% of the time, in writing?"

- "Show me a sample investment policy statement you create for clients."

- "Walk me through your fee structure with real numbers for a portfolio my size."

- "What's your process when the market drops 30% and I'm panicking?" (If they say "I'll talk you off the ledge," that's good. If they say "it never happens with our strategy," run.)

The DIY Path: Building Your Own Advice Framework

Not everyone needs or wants an advisor. You can be your own. But "DIY" doesn't mean winging it. It means building a systematic, written plan—your personal guidebook.

Step 1: Define Your "Why" with Brutal Specificity. Don't say "to retire." Say "to generate $60,000 per year in today's dollars from my portfolio by age 65, supplementing my Social Security, so I can travel three months a year." This number drives everything.

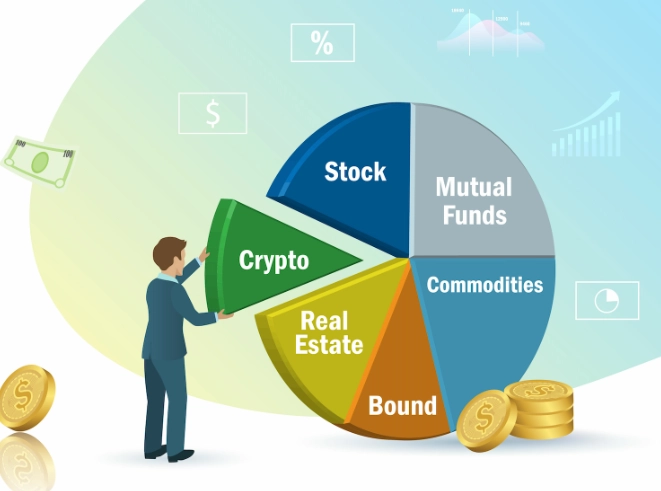

Step 2: Set Your Asset Allocation Based on Need, Not Greed. How much risk do you need to take to hit your goal? A 25-year-old doesn't need 100% stocks if they're saving aggressively for a modest goal. Use tools like the Vanguard Investor Questionnaire as a starting point, then adjust for your own stomach-churn threshold.

Step 3: Choose the Simplest Possible Vehicles. This is where most blogs stop: "Buy low-cost index funds." True, but incomplete. You need to know where to hold them. The rule of thumb: place assets with the highest expected growth (like total stock market funds) in Roth IRAs and taxable accounts, and place assets that generate income (like bonds) in traditional IRAs and 401(k)s. This maximizes tax efficiency over decades.

Step 4: Write an Investment Policy Statement (IPS). This is your contract with yourself. It states your goal, your target asset allocation (e.g., 70% global stocks, 30% bonds), your criteria for choosing funds, and—critically—your rebalancing rules. (e.g., "I will check my allocation every six months and rebalance back to target if any asset class is off by more than 5%"). This document is your behavioral guardrail.

3 Costly Mistakes Even Smart Investors Make

I've seen these patterns for years.

1. Chasing Performance in Your 401(k). You see the "International Fund" up 25% this year while your "S&P 500 Index Fund" is up 10%. So you shift money. You've just bought high and sold low. Your 401(k) menu is not a buffet where you pick the tastiest-looking dish from last night. Pick your allocation based on the fund's role (U.S. stocks, bonds, etc.), not its recent returns, and stick with it.

2. Ignoring the 'Liquidity Layer'. Everyone talks about the 3-6 month emergency fund. Few talk about the next layer: where will you pull money from if you need a new roof or decide to take a year off work? Selling stocks in a downturn to cover life expenses is a wealth killer. The advice? Keep 1-2 years of anticipated big expenses in a separate, conservative bucket (short-term bonds, high-yield savings) outside your long-term investment portfolio.

3. Letting Taxes Drive Every Decision. Yes, tax efficiency is important. But I've seen people hold onto a single, massively appreciated stock for decades to avoid capital gains tax, letting it become 40% of their portfolio. That's insane risk concentration. Sometimes, paying a tax is the best financial decision you can make to diversify and reduce risk.

Your Burning Questions, Answered

How much money should I have before seeking professional investment advice?

It's less about a specific dollar amount and more about complexity and your own bandwidth. If managing your finances feels overwhelming, you're making major life changes (like an inheritance or nearing retirement), or your investment accounts are growing beyond a simple index fund portfolio, it's time to consider advice. Many advisors now work with clients starting with $50k-$100k, and flat-fee planners offer project-based help at any asset level.

What's the single biggest mistake people make when following generic online investment advice?

They treat a one-size-fits-all asset allocation (like "60% stocks, 40% bonds") as a permanent setting. They don't factor in their personal cash flow needs, tax situation, or risk tolerance beyond a questionnaire. A portfolio that's perfect for a 30-year-old with a stable job is disastrous for someone three years from retirement or with irregular income. Generic advice ignores the need for a liquidity strategy—knowing which assets to sell first when you need cash without wrecking your long-term plan.

Can a robo-advisor provide good investment advice?

Robo-advisors are excellent for automated, low-cost portfolio management and basic tax-loss harvesting. That's their "advice": an algorithm for asset allocation. However, they fall short as comprehensive advisors. They won't help you coordinate investments across your 401(k), spouse's IRA, and taxable brokerage account. They can't advise on whether to exercise stock options, plan for a child's education with a 529, or navigate the tax implications of selling a rental property. Use them as a sophisticated tool, not a full advisor replacement.

What should I actually bring to a first meeting with a potential financial advisor?

Bring your most recent account statements (all of them), your latest tax return, a list of your debts with interest rates, and a rough monthly budget. But more importantly, bring your questions about their process, fees, and conflicts of interest. The real goal of that meeting isn't to get free advice on your portfolio; it's to assess whether their communication style, philosophy, and fee structure align with your needs. Treat it like a job interview where you're the hiring manager.

The right investment advice doesn't promise you'll get rich quick. It gives you the confidence and clarity to build wealth steadily, on your terms. It turns the market's noise into a background hum and puts your life goals at the center of the picture. Whether you hire a guide or become your own, that's the goal. Now you have the map.