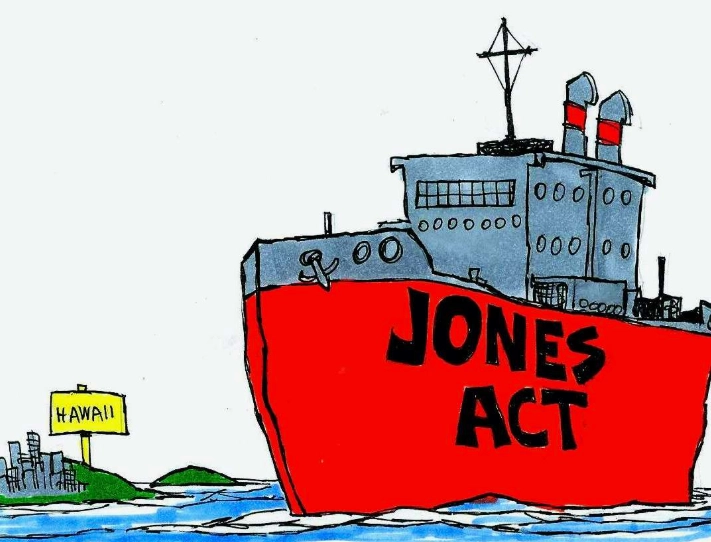

If you've ever wondered why shipping a container from Los Angeles to Honolulu costs more than sending it across the Pacific to Shanghai, or why gasoline prices in Puerto Rico can spike unpredictably, you've bumped into the long arm of the Jones Act. Officially known as the Merchant Marine Act of 1920, this isn't some dusty relic. It's a living, breathing piece of legislation that quietly shapes the cost of goods, the fate of industries, and even national security debates every single day.

Let's be honest, the Jones Act is controversial for a reason. Supporters call it the bedrock of American maritime strength. Critics label it a protectionist burden. As someone who's navigated its requirements for clients in logistics and energy, I've seen both sides. The truth, as usual, is messier and more interesting than the talking points.

What's Inside?

- What Exactly Is the Jones Act? (It's More Than Shipping)

- The Three Pillars: Key Provisions of the Jones Act

- Beyond the Law Books: The Jones Act's Real-World Impact

- Navigating Compliance: Common Pitfalls and Expert Advice

- The Never-Ending Debate: Reform, Repeal, or Status Quo?

- Your Jones Act Questions Answered

What Exactly Is the Jones Act? (It's More Than Shipping)

At its core, the Jones Act is a cabotage law. Cabotage refers to the transport of goods or people between two points within the same country. Most nations have some form of it. The U.S. version, however, is considered one of the strictest globally. It doesn't just say "use American ships." It lays down a triple requirement for vessels engaged in domestic waterborne trade:

In a nutshell: To move cargo between two U.S. ports, a vessel must be U.S.-built, U.S.-flagged, and owned and crewed by U.S. citizens. Miss one, and you're in violation.

The law was born from the ashes of World War I. Legislators watched the U.S. scramble for merchant ships and decided never again. The goal was noble: maintain a vibrant shipbuilding industry and a pool of skilled mariners for times of war or emergency. The Maritime Administration (MARAD), part of the U.S. Department of Transportation, is a key player in overseeing this ecosystem.

But here's the first nuance often missed. The "Jones Act" commonly refers specifically to the cabotage provisions (Section 27). However, the broader Merchant Marine Act of 1920 also contains Section 33, which gives seamen injured at sea the right to sue their employers for negligence. That's a huge deal in maritime personal injury law. When people argue about the "Jones Act," they're usually talking about Section 27's economic rules, but the whole package matters.

The Three Pillars: Key Provisions of the Jones Act

To understand its impact, you need to see the mechanics. The law's strength comes from how these three requirements interact.

| Requirement | What It Means | The Practical Consequence |

|---|---|---|

| U.S.-Built | The vessel must be constructed in a U.S. shipyard. | American shipbuilding costs are significantly higher than in Asia or Europe. A 2023 report by the Congressional Research Service (CRS) noted a U.S.-built tanker can cost up to four times more than a foreign-built equivalent. This limits the number of vessels available. |

| U.S.-Flagged | The vessel must be registered under the U.S. flag. | U.S. registration comes with stricter (and costlier) safety, environmental, and crewing regulations compared to "flags of convenience" like Panama or Liberia. This raises operational expenses. |

| U.S.-Owned and Crewed | At least 75% of the ownership must be U.S. citizens, and all crew members must be U.S. citizens or permanent residents. | U.S. mariner wages and benefits are higher than the international average. It also creates a limited labor pool, impacting availability and cost. |

These pillars create a closed, high-cost domestic maritime system. It's not an accident; it's by design. The trade-off is control and security. Whether that trade-off is worth it is where the debate ignites.

Beyond the Law Books: The Jones Act's Real-World Impact

This isn't abstract economics. The Jones Act touches your life, especially if you live in a non-contiguous state or territory.

Case Study 1: The Puerto Rico Problem

Puerto Rico is the poster child for the Act's contentious effects. As a U.S. territory, all sea transport from the mainland falls under the Jones Act.

I've worked with businesses in San Juan who face a brutal choice: pay the premium for Jones Act-compliant shipping from Florida, or route goods through a foreign port like Santo Domingo (Dominican Republic) and then transship them to Puerto Rico on a foreign-flagged feeder vessel. The second option adds time and complexity but can sometimes be cheaper. A study cited by the Government Accountability Office (GAO) found that shipping a container from the East Coast to Puerto Rico could be twice as expensive as shipping a similar container to nearby Santo Domingo.

This directly impacts the cost of food, construction materials, and most critically, energy. Most of Puerto Rico's oil and gas arrives by Jones Act tanker, a cost factored into utility bills.

Case Study 2: The Energy Sector Squeeze

The U.S. is an energy powerhouse, but moving that energy domestically by sea is a Jones Act puzzle. After the hurricane in 2017, the U.S. waived the Act to allow foreign vessels to deliver fuel to the Southeast. Why was that necessary? Because in a crisis, there simply aren't enough Jones Act-qualified product tankers to go around.

Here's a specific, under-discussed pain point: Liquefied Natural Gas (LNG). There are zero Jones Act-compliant LNG carriers. So, you cannot ship U.S.-produced LNG from, say, a Louisiana export terminal to a New England import terminal that might need it during a cold snap. It's legally impossible. That LNG must be sold internationally, while New England sometimes imports more expensive LNG from abroad. It's a logistical paradox that frustrates energy traders and policymakers alike.

Case Study 3: The Hawaii and Alaska Lifeline

Flip the perspective to Alaska and Hawaii, and you see the support. For these states, Jones Act carriers like Matson and Pasha are not just options; they are scheduled, reliable lifelines. These companies have invested in fleets and port infrastructure precisely because the Act guarantees them a market.

Proponents argue that without this guarantee, foreign-flagged carriers would cherry-pick the most profitable routes during peak seasons and abandon service when it's less lucrative, leaving remote communities stranded. The Jones Act, in this view, ensures stability and regularity of service, which has its own economic value.

Navigating Compliance: Common Pitfalls and Expert Advice

If you're in an industry that touches domestic waterways, compliance isn't optional. Fines are severe, and violations can lead to the seizure of cargo. Here are two mistakes I see smart people make all the time.

Pitfall #1: The "Incidental Stop" Misconception. A foreign-flagged ship carrying international cargo cannot simply make a "quick stop" at a U.S. port to drop off some domestic cargo before continuing abroad. That's illegal. The law is strict: if you transport goods between two U.S. points, the entire voyage for that cargo must be on a Jones Act vessel. There's a complex set of rules for "through bills of lading" and customs oversight, but assuming you can sneak something in as an add-on is a recipe for trouble.

Pitfall #2: Underestimating the "Vessel" Definition. It's not just massive container ships. The definition includes barges, tugboats, and offshore supply vessels. A common error in the offshore oil and wind industry involves crew transfer vessels (CTVs). If a CTV is shuttling workers from a U.S. port to a U.S.-flagged offshore installation, it likely needs to be Jones Act compliant. I've seen projects delayed because this was an afterthought, not a line item in the initial budget. The U.S. Customs and Border Protection (CBP) is the ultimate arbiter here, and their rulings are critical.

My advice? Engage a maritime attorney or consultant early in your logistics planning. The upfront cost is trivial compared to the risk of a violation.

The Never-Ending Debate: Reform, Repeal, or Status Quo?

The debate isn't binary. Full repeal is a political non-starter. The more realistic conversation is about targeted waivers, modernization, and reform.

The National Security Argument: This is the trump card for supporters. MARAD maintains that the Act sustains a core of 40,000 mariners and a network of shipyards vital for national defense sealift. In a conflict, the Military Sealift Command relies on this commercial base. Weakening it, they argue, risks a strategic vulnerability.

The Economic Burden Argument: Critics, including think tanks like the Cato Institute and some agricultural exporters, point to studies showing the Act costs the U.S. economy billions annually in higher transportation costs. They argue it makes U.S. exports less competitive and burdens consumers, especially in peripheral regions.

The Middle Ground: Practical reform ideas are gaining traction. These include creating a permanent waiver for U.S. territories like Puerto Rico and Guam, allowing the use of foreign-built (but U.S.-crewed and flagged) vessels for specific segments like LNG transport, or providing construction subsidies to modernize the aging Jones Act fleet. The challenge is balancing economic relief with the core security mission.

The political will for major change usually only surfaces after a natural disaster or a sharp price spike. For now, the Jones Act remains a fixed feature of the American economic landscape.