Quick Guide

- Guarantor vs. Co-Signer: It's Not Just Semantics

- The Real-World Responsibilities: What You're Actually Signing Up For

- Common Scenarios: Where You'll Encounter Guarantors

- Key Questions to Ask BEFORE You Sign Anything

- The Risks: The "What Could Go Wrong" Checklist

- How to Protect Yourself If You Decide to Proceed

- Frequently Asked Questions (The Stuff You're Actually Searching For)

You've probably heard the term thrown around – maybe a friend needs one for an apartment, or a family member asked you to be one for a car loan. You nod along, but in the back of your mind, you're thinking, "Wait, what does guarantor mean, really?" It sounds official, maybe a bit scary. Is it just a fancy word for a reference? A co-signer? What are you actually getting yourself into?

Let's cut through the jargon. In plain English, a guarantor is someone who promises to pay back money or fulfill a contract if the main person who borrowed the money or signed the lease can't or won't do it themselves. Think of it as a financial safety net. You're the backup plan for the lender or landlord. It's a promise with real teeth, backed by your own credit score and assets.

The request often comes from a place of need. Young adults with no credit history, newcomers to a country, freelancers with variable income – they might be perfectly responsible but lack the paper trail a big institution wants to see. That's where you come in. Your good financial standing vouches for them. But here's the thing no one talks about enough: while you're helping someone, you're also taking on a significant, open-ended risk. I've seen relationships strained over this. It's not just a signature; it's a potential long-term financial link.

Guarantor vs. Co-Signer: It's Not Just Semantics

People use these terms interchangeably, and that's a problem. The difference matters, a lot. Understanding this is crucial if you're trying to figure out what a guarantor truly is.

A co-signer is usually equally responsible from day one. Their name is on the primary contract alongside the main borrower. The lender can pursue either party for the full amount immediately if a payment is missed. It's a joint obligation right from the start.

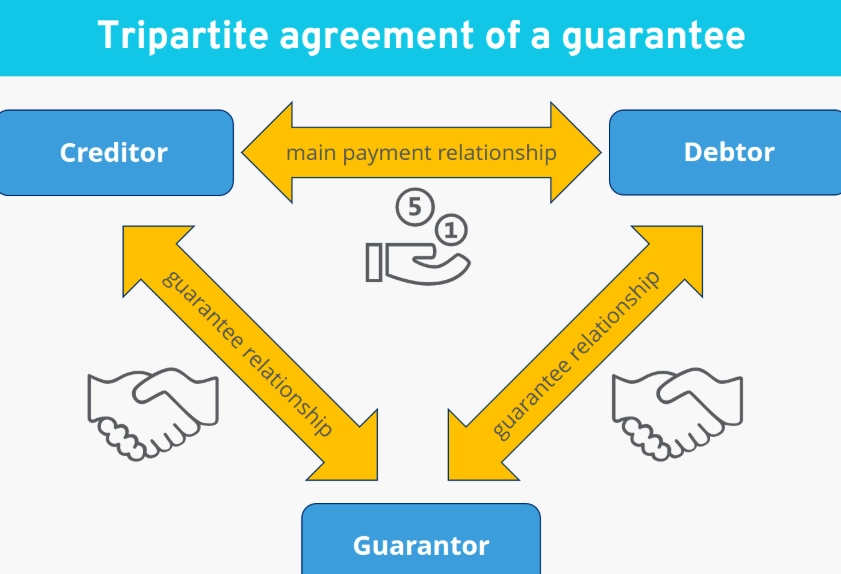

A guarantor (specifically a "guarantor of payment" which is the most common type) is more like a secondary line of defense. The lender must first try to get the money from the primary borrower. Only after that effort fails (a process sometimes called "pursuing remedies" against the primary debtor) can they formally demand payment from the guarantor. This is often outlined in a separate "guarantee agreement."

But – and this is a big but – in practice, especially with residential tenancies, many standard guarantor agreements are written so strongly that they blur this line. They might waive the requirement for the landlord to sue the tenant first. So while the technical definition of what a guarantor means suggests a secondary role, the actual contract you sign might make you just as liable as a co-signer. You must read the agreement.

| Aspect | Guarantor | Co-Signer |

|---|---|---|

| Primary Responsibility | Secondary. Pays only if the primary party defaults. | Primary. Jointly liable from the beginning. |

| Rights to the Asset | Usually has no ownership rights (e.g., can't claim the apartment or car). | Often has joint ownership rights (e.g., name on the car title). |

| Credit Impact | The debt may appear on your credit report, and defaults will definitely hurt it. | The debt will appear on your credit report as a joint obligation. |

| Common Use Case | Rental agreements, some personal loans for credit-building. | Auto loans, mortgages, loans where both parties need the asset. |

| Ease of Release | Often easier if the primary party refinances or builds sufficient credit. | Harder, usually requires refinancing into one name only. |

See the distinction? When someone asks you "what does being a guarantor mean?" you can now say it often means you're on the hook, but the creditor is supposed to try the main door first before knocking on yours. Whether they actually do is another story.

The Real-World Responsibilities: What You're Actually Signing Up For

Okay, so we've defined what a guarantor is. Now, what does a guarantor do in practical terms? It's not a passive title. Your obligations are concrete and can be triggered by a few different scenarios.

Financial Liability (The Big One)

This is the core of it. You promise to cover the financial obligation. For a rental, this means the full rent, any bounced check fees, late fees, and potentially damages if the tenant skips out and leaves a mess. For a loan, it's the remaining loan balance plus interest and penalties. There's usually no upper limit stated like "up to $500." You're agreeing to cover the entire debt.

I remember a colleague who was a guarantor for his nephew's small business loan. The business struggled, and the nephew just... stopped communicating. The bank didn't waste time. They sent a demand letter to my colleague for the full $20,000 balance. He was legally bound. That's the stark reality of what guarantor responsibility means.

Credit Score Impact

This is a sneaky one. The act of being a guarantor might not automatically show up on your credit report. However, the lender or landlord will certainly run a hard inquiry to check your creditworthiness, which causes a small, temporary dip. More importantly, if the primary borrower misses payments, that default can be reported against you as well. Your credit score, that number you've worked so hard to build, can be dragged down by someone else's mistakes. Suddenly, getting a mortgage for your own home becomes harder and more expensive.

Legal Liability

You can be sued. If you don't pay when the creditor rightfully calls in the guarantee, they will take you to court. They will win (assuming the contract is valid), and the judgment will become a public record. This can lead to wage garnishment or liens on your property. This isn't a theoretical risk. It's the enforceable endgame of the promise you made. Resources like your local state government's consumer affairs website (e.g., the Federal Trade Commission's consumer advice site) often have plain-language guides on personal guarantees and liability that are worth checking.

So when you're pondering "what does guarantor mean for me," you need to think about your savings, your future credit needs, and your legal exposure.

Common Scenarios: Where You'll Encounter Guarantors

You don't just stumble into being a guarantor. It comes up in specific situations where one party's credentials aren't quite enough for the other party's comfort. Let's look at the most frequent ones.

Rental Agreements (The Most Common Ask)

This is the classic. A landlord wants a guarantor when the prospective tenant has insufficient income (common for students), a short or poor credit history, or no prior rental history. The landlord's application criteria might state income must be 40 times the monthly rent. If the tenant only makes 30 times the rent, a guarantor who meets the 40x threshold can bridge the gap.

What does a guarantor mean for an apartment? It means the landlord has a second, qualified person to pursue if the tenant disappears or stops paying. In cities with tight rental markets, requiring a guarantor is standard practice for many young professionals. Some even turn to specialized third-party guarantor services that act as a corporate guarantor for a fee, which is an interesting alternative to asking family.

Loans (Personal, Auto, Business)

Lenders use guarantors to mitigate risk on loans to high-risk borrowers. This could be a young adult's first car loan, a personal loan for someone rebuilding credit, or a small business loan where the business's assets aren't enough collateral. The Small Business Administration (SBA), for example, has specific rules for guarantors on their loans, which you can find on the official SBA website. For an auto loan, the guarantor might not be on the title, but they're promising the bank they'll get their money one way or another.

Other Contracts (Utilities, Cell Phones)

Less common but still possible. If someone has a terrible history of not paying their phone bill, a provider might require a guarantor before giving them a new post-paid contract with a financed phone. It's the same principle.

Key Questions to Ask BEFORE You Sign Anything

Don't just say yes out of obligation or awkwardness. Getting clear answers to these questions is the most important step in understanding what being a guarantor will truly mean for your life.

- Can I see the full, final contract? Not a summary, the actual legal document you will sign. Read every word, especially the clauses about "default," "demand," and "liability."

- What is the exact dollar amount and duration of my guarantee? Is it for the full lease term? The entire loan period? Is it limited or unlimited?

- What are the conditions that would trigger my obligation? Is it one missed payment? Do they have to evict the tenant first? How much notice will I get?

- How will this be reported on my credit profile? Will the account appear on my report? Will I be notified of late payments?

- What is the exit strategy? Can the primary borrower remove me after 12-24 months of good payments by proving their own creditworthiness? What's the process?

- What is the financial health of the person I'm guaranteeing? This is awkward but essential. Can you see their budget? Do they have a stable job? What's their plan if they get sick or laid off?

If the person asking you gets defensive about these questions, that's a major red flag. A responsible person who understands what a guarantor is taking on will be transparent.

The Risks: The "What Could Go Wrong" Checklist

We've touched on risks, but let's lay them out plainly. This is the downside of understanding what a guarantor means.

- Relationship Damage: Money ruins relationships. If you have to pay, resentment builds. If you refuse to pay when called upon, the relationship is likely over.

- Unexpected Financial Burden: The money you might have to pay isn't theoretical. It's cash from your savings, your kid's college fund, your retirement.

- Credit Score Destruction: A default can stay on your report for seven years, affecting loan rates, insurance premiums, and even some job applications.

- Legal Action: Lawsuits are stressful, time-consuming, and create public records.

- Debt-to-Income Ratio Impact: If you need a loan yourself, the lender may count the guaranteed debt against your debt-to-income ratio, potentially disqualifying you.

It’s a lot. And sometimes, even with the best intentions from everyone at the start, life happens. Jobs are lost, accidents occur, people make poor decisions.

How to Protect Yourself If You Decide to Proceed

Let's say you've thought it through, asked the hard questions, and decided to go ahead. How do you mitigate the risks? How do you make the definition of a guarantor work for you without getting burned?

1. Negotiate the Terms of the Agreement

Most people think these forms are non-negotiable. They often aren't. You can propose addendums. For example:

- Limit the Guarantee: Try to cap your liability to just the rent or loan payments, excluding fees, damages, or legal costs.

- Set a Time Limit: Propose that the guarantee automatically terminates after 18 or 24 months, provided payments have been on time.

- Require Notification: Insert a clause that the lender/landlord must notify you in writing within 5 days of any missed payment by the primary party. This gives you a chance to intervene early.

2. Create a Side Agreement with the Borrower

This is between you and the person you're helping. It's not legally binding to the bank/landlord, but it sets clear expectations. Put in writing that they agree to provide you with monthly proof of payment (a screenshot of the confirmation), that they will notify you immediately of any financial trouble, and that they are responsible for any costs you incur. It feels formal, but it reinforces the seriousness of the arrangement.

3. Keep Your Own Records

Keep a file with: the signed guarantee agreement, the main lease or loan contract, proof of the borrower's payments (if you get it), and all communication. If things go south, you'll need this paper trail.

4. Consider Alternatives First

Is there another way? Could the person save for a larger security deposit instead? Could they get a loan with a higher interest rate but no guarantor? Could you lend them the money for a larger deposit directly, with a clear repayment plan to you? Sometimes the alternatives, while not perfect, carry less open-ended risk than a guarantee.

Understanding what a guarantor is also means understanding the alternatives to being one.

Frequently Asked Questions (The Stuff You're Actually Searching For)

It can, yes. When a mortgage lender assesses your application, they look at your debts and obligations. If the loan you guaranteed is sizable, they may factor that potential liability into your debt-to-income ratio. Even if payments are current, the potential for you to have to make that payment is a risk in their eyes. You must disclose this obligation on your mortgage application.

Not unilaterally. You are bound by the contract you signed for its duration. The only ways out are: 1) The contract expires (lease ends, loan is paid off). 2) The primary party releases you by refinancing the loan or qualifying for a new lease on their own, and the lender/landlord agrees in writing to release you. 3) All parties (you, the primary party, and the creditor) agree in writing to terminate the guarantee. You can't just change your mind.

This is a tough one. The creditor's claim against the primary borrower may be discharged in bankruptcy, but your separate guarantee agreement likely remains valid. The creditor can then pursue you for the full amount. Bankruptcy of the main debtor often triggers the guarantee. It's one of the key risks that answers the deeper question of "what does being a guarantor mean in a worst-case scenario?"

Almost never. It's typically a favor, not a paid service. However, in commercial settings, a guarantor might receive a fee. For personal situations like family loans or rentals, no, you don't get paid. Your "reward" is helping someone you care about (and hopefully, their continued financial responsibility).

A huge one. A reference provides a character opinion, usually verbally or in a letter. They have no legal or financial liability. A guarantor signs a legally binding contract accepting financial liability. A landlord might call a reference to ask if you're a good person; they call a guarantor to demand money.

Before you put pen to paper, make sure you're comfortable not just with the definition, but with the very real possibility that you might have to fulfill the promise you're making. Your signature has weight. Now you know exactly how much.