Let's cut to the chase. You're running a business, or managing a department, and you're staring at a spreadsheet full of costs. Rent, salaries, materials, utilities... it's a mess. The big question hanging over you is simple: "Will this next decision make me money or lose it?" Should you drop your price to match a competitor? Should you accept that weird, low-margin custom order? Is it worth running the production line for one more hour?

If you're using the standard "fully loaded" cost per unit from your accountant, you're probably making these calls in the dark. You might be turning away profitable opportunities or, worse, chasing business that's actually eroding your cash. The secret weapon you're missing isn't a fancy software—it's a way of thinking. It's understanding marginal cost and using marginal costing.

This isn't just textbook theory. It's the difference between reactive guesswork and strategic, profitable decision-making.

What You'll Learn Today

- What Marginal Cost Really Is (And Isn't)

- Marginal Costing vs. Absorption Costing: The Manager's Dilemma

- Where Marginal Costing Changes the Game: Real-World Applications

- The Hidden Traps: Where Managers Get Marginal Costing Wrong

- How to Start Using Marginal Costing Tomorrow

- Your Burning Questions Answered

What Marginal Cost Really Is (And Isn't)

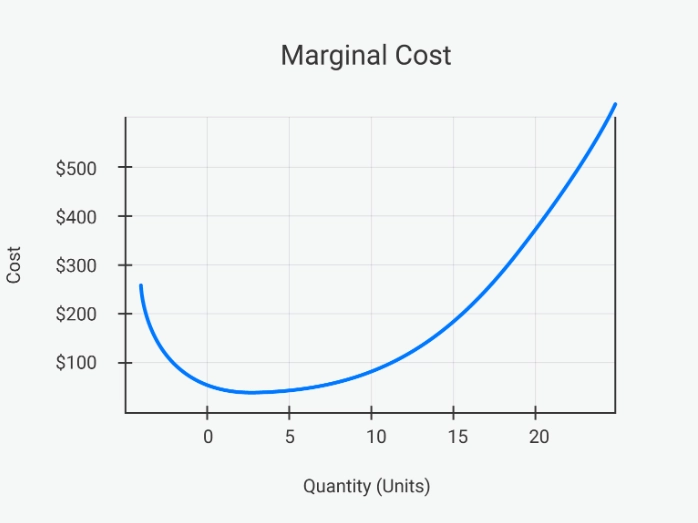

Marginal cost is brutally simple: it's the cost of producing one more unit of something. Just one. Not the average cost. Not the total cost. The *next* one.

Think of it like this. You own a bakery. You've already paid this month's rent, the head baker's salary, and the loan on the oven. These are fixed costs—they don't change whether you bake 100 loaves or 1,000 loaves today. Now, you're deciding whether to bake a 101st loaf for a last-minute catering order.

What costs do you actually incur for that extra loaf?

- A bit more flour, yeast, and water (direct materials).

- Maybe 5 extra minutes of the assistant baker's time, if it pushes them into overtime (direct labor, but only if it changes).

- A tiny fraction of extra electricity to run the oven.

That's it. You do not allocate a slice of the rent, the head baker's salary, or the oven depreciation to this decision. Those costs are sunk for the day. The marginal cost of that 101st loaf is just the cost of the extra stuff you need to make it.

Marginal Costing vs. Absorption Costing: The Manager's Dilemma

Now, let's bring in marginal costing (often called variable costing). This is an entire costing method built on the marginal cost principle.

In your financial reports, you likely use absorption (or full) costing. This is the standard, GAAP-compliant method. It assigns all manufacturing costs—both variable and a fair share of fixed factory overhead—to each unit. The unit cost looks "complete."

Marginal costing strips that back. It only assigns variable costs (materials, direct labor if variable, variable overhead) to products. All fixed costs are treated as a period expense, deducted in total from the contribution margin.

Here’s a side-by-side look at how this plays out in an income statement for a company making 10,000 widgets:

| Income Statement Line Item | Absorption Costing View | Marginal Costing View |

|---|---|---|

| Sales (10,000 units @ $15) | $150,000 | $150,000 |

| Cost of Goods Sold | ($80,000) (Includes $30k fixed overhead) |

— |

| Gross Profit | $70,000 | — |

| Variable Costs | — | ($50,000) |

| Contribution Margin | — | $100,000 |

| Fixed Costs (Period) | ($30,000) (Selling & Admin only) |

($60,000) (All fixed: Factory + S&A) |

| Net Operating Income | $40,000 | $40,000 |

Notice the bottom line is the same (it has to be). But the story is different. Marginal costing screams: "For every $15 widget we sell, we first contribute $10 ($15 - $5 variable cost) toward covering our fixed costs. Once we sell 6,000 units ($60k fixed costs / $10 contribution per unit), every additional sale is pure profit."

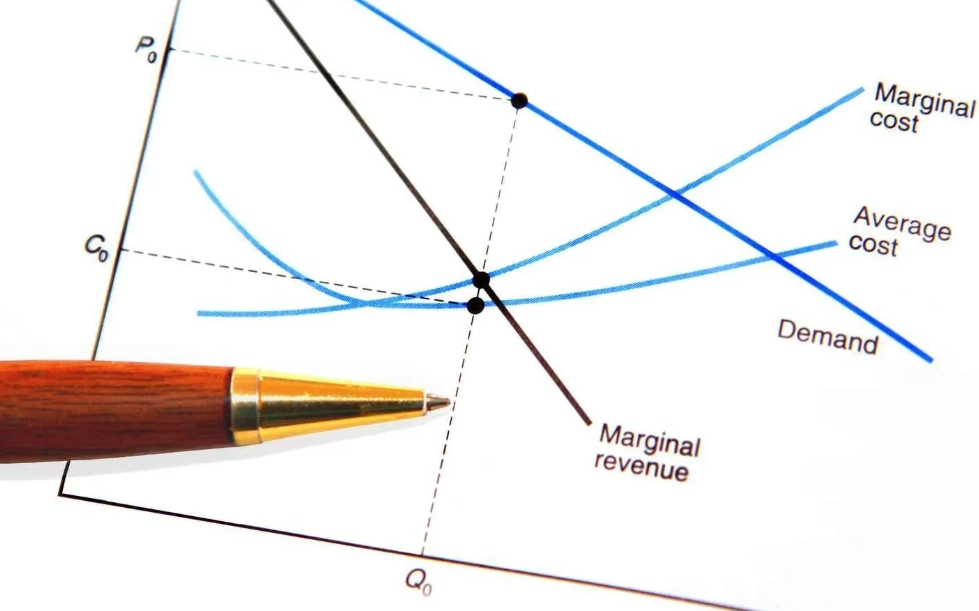

Absorption costing buries that clarity. It mixes variable and fixed costs together, making it harder to see the direct impact of selling one more unit.

Where Marginal Costing Changes the Game: Real-World Applications

This isn't academic. Here’s where this mindset creates real dollars.

1. Pricing Special Orders or Discounts

A hotel has empty rooms on a Tuesday night. The marginal cost of selling one more room is tiny: a bit of cleaning, utilities, and maybe a free breakfast. The fixed costs (mortgage, front desk staff, management) are already paid. A last-minute booking at a heavily discounted rate that still exceeds this marginal cost is pure profit. Airlines have mastered this.

2. Make-or-Buy Decisions

Should you outsource a component? Compare the price from the supplier to your marginal cost of making it in-house. If your marginal cost (extra materials, extra labor hours) is $8 and a supplier offers it for $10, you keep making it. If your absorption cost (which includes fixed overhead) is $12 and you compare to the $10 supplier quote, you might incorrectly outsource and lose capacity you've already paid for.

3. Optimizing Product Mix

If you have limited capacity (e.g., machine time), you should prioritize products with the highest contribution margin per unit of the limiting factor, not the highest gross profit percentage. Marginal costing makes this calculation obvious.

Case Study: The Custom T-Shirt Shop

"Ink & Thread" runs a printing press 8 hours a day. They have two orders:

- Order A: 100 shirts, complex design. Sales: $1,000. Direct variable costs (shirts, ink): $400. Takes 4 hours to print.

- Order B: 500 shirts, simple logo. Sales: $1,500. Direct variable costs: $750. Takes 5 hours to print.

Using gross margin (Absorption Costing logic): Order A has a 60% margin ($600/$1000), Order B has a 50% margin ($750/$1500). You'd pick A.

Using marginal costing contribution per limiting factor (press time):

- Order A Contribution: $1,000 - $400 = $600. Per hour: $600 / 4 hrs = $150/hr.

- Order B Contribution: $1,500 - $750 = $750. Per hour: $750 / 5 hrs = $150/hr.

They're equal! But if Order B took only 4.5 hours, its rate would be ~$167/hr, making it the clear winner. Marginal costing reveals this; gross margin hides it.

The Hidden Traps: Where Managers Get Marginal Costing Wrong

After seeing its power, it's tempting to use marginal costing everywhere. Don't. Here are the subtle, expensive mistakes I've seen managers make over and over.

Trap 1: Using it for long-term strategic pricing. Marginal cost is a floor for short-term tactical moves, not your standard price. If you price everything just above marginal cost, you'll never cover your total fixed costs and you'll go bankrupt. It's for filling idle capacity, not defining your value.

Trap 2: Ignoring capacity constraints. The biggest error? Assuming "idle capacity" is infinite. If that "special order" uses your only skilled technician for a month, you're not just incurring marginal costs. You're allocating a strategic resource. You've now lost the capacity to do other, potentially more profitable work. This is the classic "we sold our bottleneck for peanuts" failure.

Trap 3: Forgetting the "one-time only" assumption. You offer a deep discount to a new client based on marginal cost. What happens when they come back next month and expect the same price? Or when your regular clients find out? You've eroded your price point and brand value. Marginal pricing must be situationally contained.

How to Start Using Marginal Costing Tomorrow

You don't need to overhaul your accounting system. Start with a pen, paper, and one decision.

- Pick a recent "close call" decision—a order you almost took or a discount you almost gave.

- List every cost associated with fulfilling it. Be ruthless. Ask for each one: "If we say NO to this, do we avoid spending this money in the short term?" If the answer is no (like rent, salaried staff with free time), it's fixed. Cross it off for this decision.

- Sum the costs you didn't cross off. That's your estimated marginal cost.

- Compare to the revenue. If revenue > marginal cost, the decision contributes to fixed costs and profit.

- Apply the "trap test." Does it use a critical, scarce resource? Could it set a bad price precedent? If yes, think twice.

Do this a few times. You'll start to see your business through a new lens—a lens focused on incremental contribution and strategic resource use, not just spread-out averages.

Your Burning Questions Answered

Is marginal cost the same as variable cost?

How do I calculate marginal cost for a service business?

When should I NOT use marginal costing for pricing?

What's the biggest mistake managers make with marginal costing?