What You'll Learn in This Guide

Let's cut to the chase. If you're running a business, setting prices, or just trying to understand economics, marginal revenue isn't some abstract academic term—it's the heartbeat of your profit decisions. I've seen too many entrepreneurs wing it with pricing because they think revenue math is for textbooks. But here's the truth: ignoring marginal revenue can silently drain your profits. In this guide, I'll walk you through what it really means, how to calculate it without headache, and share real stories where it made or broke a business. You'll get actionable insights, not just theory.

What is Marginal Revenue? Beyond the Textbook Definition

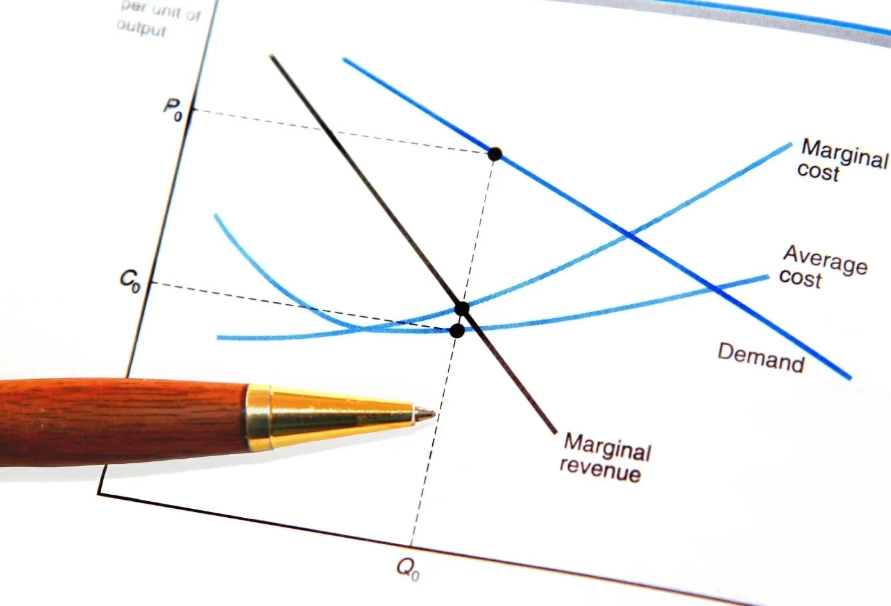

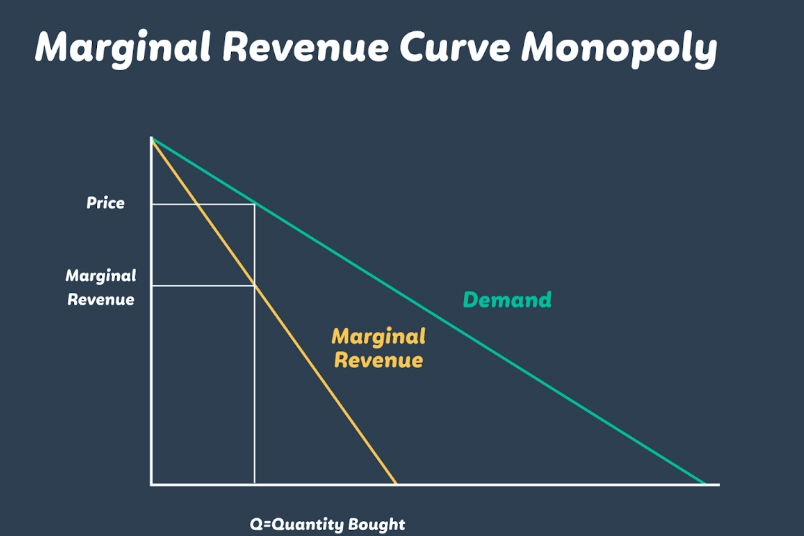

Marginal revenue is the extra revenue you earn from selling one more unit of a product. Sounds simple, right? But most people miss the nuance: it's about the change in total revenue, not the average. In competitive markets, selling more might mean lowering prices, which can squeeze your earnings per unit. That's where marginal revenue becomes critical—it tells you whether that extra sale is actually worth it.

Think of a bakery selling cupcakes. If you drop the price from $3 to $2.50 to attract more customers, the marginal revenue isn't just $2.50; it's the change in total revenue divided by the change in units sold. If that change is negative, you're losing money on each additional cupcake. Economists like those at the U.S. Bureau of Economic Analysis emphasize this incremental thinking for sound decision-making. But in practice, many owners rely on gut feeling, which often leads to underpricing.

Here's a personal anecdote. Early in my consulting career, I worked with a local bookstore. The owner thought offering a 20% discount on slow Tuesdays would boost sales. We calculated the marginal revenue and found that the extra books sold barely covered the discount—the marginal revenue was almost zero. Instead, we switched to bundling a book with a coffee, which increased marginal revenue by 15%. Small tweak, big impact.

How to Calculate Marginal Revenue: A No-Nonsense Walkthrough

Forget the complex jargon. Calculating marginal revenue boils down to a straightforward formula, but the devil's in the details. The basic formula is: Marginal Revenue (MR) = Change in Total Revenue / Change in Quantity Sold. Let's break it down with a concrete example.

Imagine you run a SaaS company offering a project management tool. Your current pricing is $10 per user per month, and you have 100 users, so total revenue is $1,000. You're considering a promotion: drop the price to $9 to attract more users. After the change, you gain 20 new users, totaling 120 users. New total revenue is 120 * $9 = $1,080.

Now, plug into the formula:

- Change in Total Revenue = $1,080 - $1,000 = $80

- Change in Quantity Sold = 120 - 100 = 20

- Marginal Revenue = $80 / 20 = $4

See the surprise? Even though the price is $9, the marginal revenue is only $4 because the price cut reduced revenue from existing users. This is a classic trap—if your marginal cost to serve an extra user is $5, you're actually losing $1 per new user. That's why calculation matters.

The Role of Demand Elasticity

Marginal revenue ties directly to how sensitive your customers are to price changes. If demand is elastic (a small price drop brings lots of new sales), marginal revenue stays positive. If it's inelastic (price drops don't boost sales much), marginal revenue can plummet. For instance, gasoline often has inelastic demand; a gas station lowering prices might not see a surge, so marginal revenue could be low or negative. Resources like the Federal Trade Commission reports on consumer behavior can offer insights here.

To make this tangible, here's a table showing how marginal revenue shifts with different demand scenarios for a hypothetical product:

| Price per Unit | Quantity Sold | Total Revenue | Marginal Revenue | Demand Type |

|---|---|---|---|---|

| $50 | 10 | $500 | — | Starting Point |

| $45 | 15 | $675 | $35 | Elastic (Good) |

| $40 | 18 | $720 | $15 | Less Elastic (Caution) |

| $35 | 20 | $700 | -$10 | Inelastic (Negative MR) |

Notice how marginal revenue drops and turns negative? That's the warning sign to stop lowering prices.

Marginal Revenue in Action: Case Studies That Changed Companies

Let's move from theory to reality. Marginal revenue isn't just for economics exams—it drives decisions in tech, retail, and services. Here are two cases where it played a pivotal role.

Case Study 1: Streaming Service Pricing Dilemma

A mid-sized streaming platform (let's call it StreamFlow) faced subscriber stagnation. Their initial plan: a blanket 10% price cut across all tiers. Sounds logical, but we analyzed marginal revenue. For the basic tier, demand was elastic—a price cut boosted sign-ups, and marginal revenue increased by $3 per new subscriber. For the premium tier, demand was inelastic; loyal users didn't care much about price, so marginal revenue fell by $5 per subscriber.

The result? StreamFlow shifted to a targeted discount: basic tier got the cut, premium tier stayed put with added features. Within a quarter, overall revenue grew 8% because marginal revenue guided where to push. This mirrors strategies discussed in industry analyses from sources like McKinsey & Company on digital pricing.

Case Study 2: Restaurant Happy Hour Revamp

A casual dining spot offered happy hour discounts from 4-6 PM, slashing drink prices by 30%. The manager assumed it packed the house, but when we tracked marginal revenue, it was barely positive—the extra drinks sold didn't offset the discount on regulars who'd come anyway. The hidden cost? Kitchen staff were overwhelmed for minimal gain.

We tweaked it: instead of a price cut, they introduced a "buy one, get one half-off" deal after 6 PM. This increased marginal revenue by focusing on incremental sales during slower hours. Sales jumped 15% without eroding margins. It's a lesson in using marginal revenue to optimize timing, not just price.

Common Pitfalls in Using Marginal Revenue (And How to Sidestep Them)

After years advising businesses, I've spotted patterns where even savvy folks stumble. Here's the lowdown on mistakes to avoid.

Pitfall 1: Confusing Marginal Revenue with Average Revenue. This is huge. Average revenue is total revenue divided by units—it's backward-looking. Marginal revenue is forward-looking. If you base decisions on average, you might think selling an extra unit at a slightly lower price is fine, but if marginal revenue is tanking, you're bleeding profit. Always calculate the incremental change.

Pitfall 2: Ignoring Fixed Costs in Marginal Thinking. Marginal revenue focuses on variable costs, but some managers forget that fixed costs (like rent) still loom. If marginal revenue covers variable costs but doesn't contribute to fixed costs over time, you're not really profitable. Use marginal revenue as a short-term guide, but pair it with overall profit analysis.

Pitfall 3: Overlooking Competitor Reactions. In dynamic markets, your price change might trigger rivals to slash prices too, altering demand elasticity. Your marginal revenue calculation assumes ceteris paribus (all else equal), but in reality, nothing stays equal. Scenario planning helps—estimate how marginal revenue might shift if competitors respond.

My rule of thumb: treat marginal revenue as a compass, not a map. It points direction, but you need to watch the terrain.

Your Burning Questions Answered

Marginal revenue isn't a magic bullet, but it's a lens that brings pricing and profit into sharp focus. From my experience, businesses that embrace it tend to make fewer knee-jerk decisions and more calculated moves. Start small—pick one product, track changes, and see how marginal revenue guides you. Remember, in economics and business, the margin is where the action happens. Don't let it slip by.