Quick Guide

So, you're probably here because someone asked you to sign one, or maybe you need to lend money to a friend or family member and want to do it right. You typed "what is a promissory note" into Google, and now you're staring at a bunch of legal jargon that makes your head spin. I get it. The first time I saw one, I thought it was just a fancier version of a sticky note with a promise written on it. Boy, was I wrong.

Let's cut through the noise. At its heart, a promissory note is a financial instrument, a written promise to pay a specific sum of money to a specific person (or entity) at a specific time. Think of it as the formal, legally-binding version of an IOU you might scribble on a napkin. But this one actually holds up in court. It's the backbone of most loans, from massive bank mortgages to that $500 you loan your cousin to fix his car.

If you remember nothing else, remember this: A promissory note is proof of debt. It doesn't create the loan—the act of handing over money does that—but it documents the borrower's promise to pay it back under agreed terms. It's the "what" and "when" of the debt.

Now, why should you care? Well, if you're the lender, it's your primary piece of evidence if things go south. If you're the borrower, it clearly spells out your obligations so there's no confusion later. Skipping this step, especially with personal loans, is how family dinners get awkward and friendships end. I've seen it happen.

It's Not Just a Piece of Paper: The Core Anatomy of a Promissory Note

Anyone can write "I promise to pay you back" on a scrap of paper. For it to be a legitimate promissory note that a court would take seriously, it needs specific ingredients. Miss one, and you might have a useless document. Here’s what absolutely must be in there.

The Non-Negotiables: Five Elements That Make It Legal

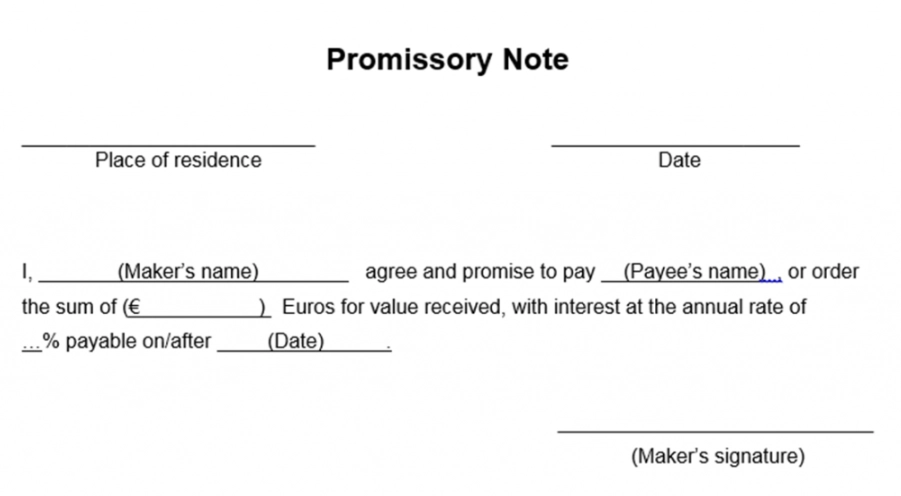

First, the maker (that's the borrower) and the payee (that's the lender) need to be clearly identified with full names and addresses. No "I owe Bob" stuff. Which Bob?

The principal amount is next. This is the actual sum of money being loaned, written in both numbers and words to prevent tampering. You'd write "$5,000.00 (Five Thousand and 00/100 Dollars)."

Then comes the promise to pay. This is the core legal phrase. It must be an unconditional promise, like "The Maker hereby promises to pay to the order of the Payee..." It sounds formal for a reason—it removes any "ifs" or "buts."

The repayment terms are the meat of the agreement. This section answers "what is a promissory note" in practical terms. Is it a lump sum on a specific date? Monthly installments? If so, how much and on what day? You need to detail the schedule.

Finally, it must be signed by the borrower (the maker). Without a signature, it's basically a suggestion. Some states require witnesses or a notary public to make it extra solid, especially for larger sums. It's a good habit.

A huge mistake people make is being vague. "I'll pay you back when I can" is an invitation for conflict. A proper promissory note demands specifics: dates, amounts, and methods.

Beyond the Basics: The Clauses That Protect You

Once you have the core five, you can add clauses that protect both parties. This is where you tailor the note to your specific situation.

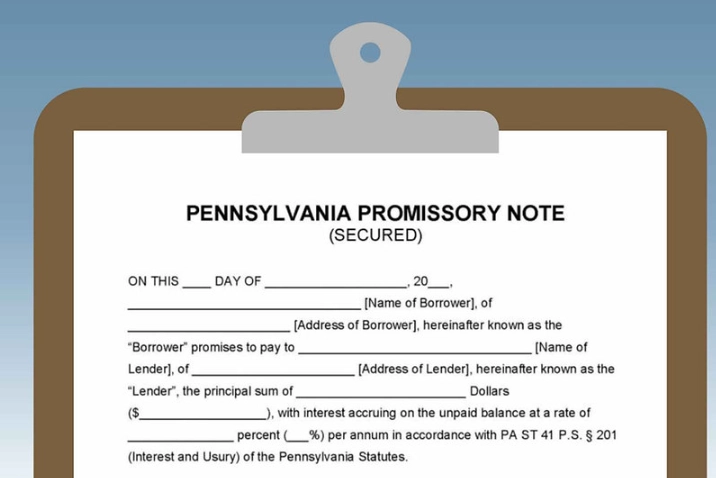

The interest rate clause is a big one. Are you charging interest? In many places, if you don't specify an interest rate, the court might apply a statutory rate, or worse, it could be considered a gift for tax purposes. You need to state the annual percentage rate (APR) clearly. For private loans, you must be aware of your state's usury laws which cap the maximum legal interest rate. Charging more is illegal.

Security or collateral. This transforms a simple promissory note into a secured promissory note. It states that if the borrower defaults, the lender has a claim on a specific asset, like a car title or property. This is crucial for larger loans. An unsecured note has no collateral backing it—it's just a promise, which is riskier for the lender.

Default clause. What exactly constitutes a default? Late payment by 15 days? Missing a payment entirely? Bankruptcy? This clause triggers the lender's right to take action, like demanding the full balance immediately (an acceleration clause).

Payment allocation clause. If payments are applied to interest first and then principal, say so. It matters for calculating the remaining balance.

Let's look at the two main families of notes. It really comes down to one question: is there something backing the loan?

| Feature | Secured Promissory Note | Unsecured Promissory Note |

|---|---|---|

| Collateral | YES. Linked to a specific asset (e.g., house, car). | NO. Based solely on the borrower's promise. |

| Risk for Lender | Lower. Can seize the asset if the borrower defaults. | Higher. Must pursue the borrower personally. |

| Risk for Borrower | Higher. Risk of losing the asset. | Lower. No specific asset is immediately at risk. |

| Common Use | Mortgages, auto loans, large personal/business loans. | Small personal loans between individuals, some student loans. |

| Enforcement | Can involve foreclosure or repossession of the collateral. | Requires a lawsuit to obtain a judgment, then collection efforts. |

See the difference? If you're lending a significant amount, you'll sleep better with a secured note. But getting collateral isn't always practical or necessary for smaller, trusted loans.

From Blank Page to Binding Document: How to Write a Promissory Note

You don't need a law degree. But you do need attention to detail. Here's a walkthrough.

Start with a template. The U.S. Securities and Exchange Commission or your state's government website often have basic, reliable forms. I'd steer clear of random internet templates that look spammy. Using an official source as a starting point is smart.

Fill in every blank. Don't leave anything to "we'll figure it out later." Later is when memories fade and disagreements start.

- Date: The date the note is signed and effective.

- Parties: Full legal names and current addresses of both borrower and lender.

- Principal Amount: The loan amount, in numbers and words.

- Interest Rate: The annual percentage rate (APR). If no interest, write "0%" or "This loan bears no interest."

- Repayment Schedule: Be painfully specific. "$200 on the first of every month, starting June 1, 2023, until the balance is paid in full."

- Maturity Date: The final date by which the entire debt must be repaid.

- Payment Method: Check, bank transfer, cash? Where should payments be sent?

- Late Fees: Are there any? How much and when do they apply?

- Governing Law: Which state's laws will govern the agreement? Usually the state where the lender lives.

Pro Tip: Even for a simple loan, create two identical copies. Both parties sign both copies. Each keeps an original. This prevents "I lost it" or "My copy is different" scenarios.

Sign and witness. The borrower signs. Having a witness or two sign (with printed names and addresses) adds a layer of verification. For real estate transactions, a notary public is almost always required. For other large notes, it's a cheap and wise step.

What does a good promissory note feel like? It should leave no room for interpretation. If you read it a year later, the terms should be crystal clear to a stranger.

When Promises Break: How to Enforce a Promissory Note

This is the part nobody wants to think about, but it's the whole reason you have the note. Let's say payments stop. What now?

First, don't panic. Refer to the default clause in your note. Usually, there's a grace period. Send a formal, polite written reminder (email is fine, but certified mail is better for proof). Sometimes life happens—a lost job, a medical bill. Give a brief chance for communication.

If that fails, you send a formal demand letter. This isn't an angry text. It's a letter stating the default, citing the relevant clause from the promissory note, and demanding payment of the overdue amount (or the full accelerated balance, if your note allows that) by a specific date, say 15 days. Mention that legal action will follow if payment is not received. Keep a copy.

If the demand letter is ignored, you move to legal enforcement. The process depends on whether the note is secured or unsecured.

For a secured promissory note, the path is clearer but can be lengthy. You initiate foreclosure (for real estate) or repossession (for vehicles or equipment) proceedings according to your state's laws. These laws are strict to protect borrowers from unfair seizure, so you'll likely need a lawyer. The collateral is sold, and the proceeds pay off the debt.

For an unsecured promissory note, you must file a lawsuit for breach of contract. You'll present the signed note as your primary evidence. If you win, the court issues a money judgment against the borrower. But a judgment isn't cash. You then have to collect, which can involve garnishing wages, placing liens on property, or seizing bank accounts—all through additional legal procedures. It can be a hassle.

Honestly, the threat of legal action is often enough. Most people don't want a judgment on their record. But you have to be willing to follow through.

Navigating the Gray Areas: Common Questions and Pitfalls

Is a promissory note legally binding if it's not notarized?

Usually, yes. A signature generally makes it binding. Notarization doesn't make it more "legal"; it provides verification that the signature is genuine. It's a strong layer of proof if authenticity is ever disputed in court. For any substantial amount, just get it notarized. It's cheap insurance.

Can you forgive or cancel a promissory note?

Absolutely. As the lender, you can cancel the debt. The proper way is to write a "Cancellation of Promissory Note" or "Debt Release" document, sign it, and give it to the borrower. Also, mark the original note as "CANCELLED" and give it back. This prevents you from accidentally trying to enforce it later. There can be tax implications for the borrower on forgiven debt over a certain amount, so they should be aware.

What's the difference between a promissory note and a loan agreement?

People use these terms interchangeably, but there's a technical difference. A promissory note is a one-sided promise from the borrower to pay. It's usually shorter. A loan agreement is a more comprehensive contract between both parties. It includes the note's promise but also covers everything else: what the loan can be used for, insurance requirements, what happens if the borrower dies, covenants (like maintaining certain financial ratios), and more detailed remedies. A promissory note can stand alone for simple loans; complex transactions use a full loan agreement.

The Big Tax Question

The IRS is always watching. If you charge interest, you must report that interest as income. The borrower generally cannot deduct interest on a personal loan (different rules for mortgages or business loans). If you forgive a debt, the forgiven amount may be considered taxable income to the borrower. For significant sums, a quick chat with a tax pro is worth it. The IRS website has publications on canceled debt (like Form 1099-C), but it's dense reading.

My personal least favorite pitfall? The handshake loan between friends. "We don't need paperwork, I trust you." Fast forward six months, memories differ on the amount, the repayment schedule, everything. The relationship is damaged, and you have no legal recourse. The act of creating a clear promissory note isn't distrustful—it's the opposite. It ensures everyone is on the same page, protecting the relationship.

Putting It All Together: Your Action Plan

So, the next time you face a situation involving lending or borrowing money, don't wing it. Understanding what a promissory note truly is gives you control.

If you're the lender, be the responsible one. Propose putting the terms in writing. Frame it as a way to avoid future confusion. Use a clear template, fill in all the details, and get it signed properly. Decide if collateral makes sense.

If you're the borrower, insist on it. A well-drafted note protects you from changing terms or fuzzy recollections. You know exactly what you owe and when. Read every line before you sign.

Keep the note in a safe place with your other important documents. Make payments on time and keep records. If you're the lender, keep a ledger of payments received.

At the end of the day, a promissory note is a tool. A simple, powerful tool that turns a verbal promise into a documented, manageable obligation. Whether it's for a house, a car, or helping out someone you care about, using this tool correctly saves a lot more than just money—it saves relationships, time, and a massive amount of stress.

Now you know not just what is a promissory note, but why it matters and how to use it. That's more than most people know, and it puts you in a much stronger position.