Key Points to Explore

- So, What Exactly Does Net Income Mean?

- Why Net Income is Your Business's Report Card

- How to Calculate Net Income: The Step-by-Step Breakdown

- Net Income vs. Gross Profit: The Crucial Difference Everyone Misses

- What Factors Can Impact Your Net Income?

- Common Mistakes and Misconceptions About Net Income

- Net Income in the Real World: Beyond Your Own Books

- Frequently Asked Questions About Net Income

- Putting It All Together: Net Income as Your North Star

Let's talk about profit. You know, the thing we're all in business for? Well, it turns out there's profit, and then there's net income. And if you're mixing those two up, you might be in for a nasty surprise come tax season, or worse, when you're trying to figure out if your business is actually making money.

I remember when I first started my little side hustle selling custom coffee mugs online. I'd look at my PayPal account, see money coming in, and think "Great! I'm profitable!" Then the bills for the mug printer, the shipping supplies, the website hosting, and a dozen other things would hit. Suddenly my "profit" looked a lot less impressive. That's when I had to get real about understanding the net income meaning.

It's not just accounting jargon. It's the most honest number on your financial statement.

So, What Exactly Does Net Income Mean?

In the simplest terms possible, net income is what's left in your pocket after you've paid every single expense required to run your business. Every. Single. One. It's your total revenue minus your total expenses. That's the core of the net income meaning.

You'll also hear it called "the bottom line," and for good reason. It's literally the last line on your income statement (also called a Profit & Loss statement). It's the final answer to the question "Did we make money this period?"

Here’s the official, textbook-style definition from a reliable source like Investopedia: "Net income is a company's total earnings (or profit). Net income is calculated by taking revenues and subtracting the costs of doing business such as depreciation, interest, taxes, and other expenses."

But let's move past the textbook. Why should you, as a business owner, care?

Why Net Income is Your Business's Report Card

Profit is simple, right? Money in minus money out. Well, not quite. The true meaning of net income goes deeper. It's the definitive measure of your business's profitability over a specific period—a month, a quarter, or a year. It tells you if your core business model actually works.

You can have a ton of revenue (top line) and still have a negative net income (a net loss). I've seen it happen. A friend ran a seemingly booming food truck. Lines out the door! But between the cost of gourmet ingredients, truck maintenance, permits, and city fees, he was barely breaking even. He was focused on the cash in the register, not the net income calculation. That's a dangerous place to be.

Net income answers critical questions:

- Can this business sustain itself?

- Do we have money to reinvest in growth?

- Can we pay dividends to owners or investors?

- What's our actual tax liability?

- Are we efficient, or are we wasting money somewhere?

If you're seeking a loan or investment, bankers and investors will scrutinize your net income more than any other number. It's your financial credibility score.

How to Calculate Net Income: The Step-by-Step Breakdown

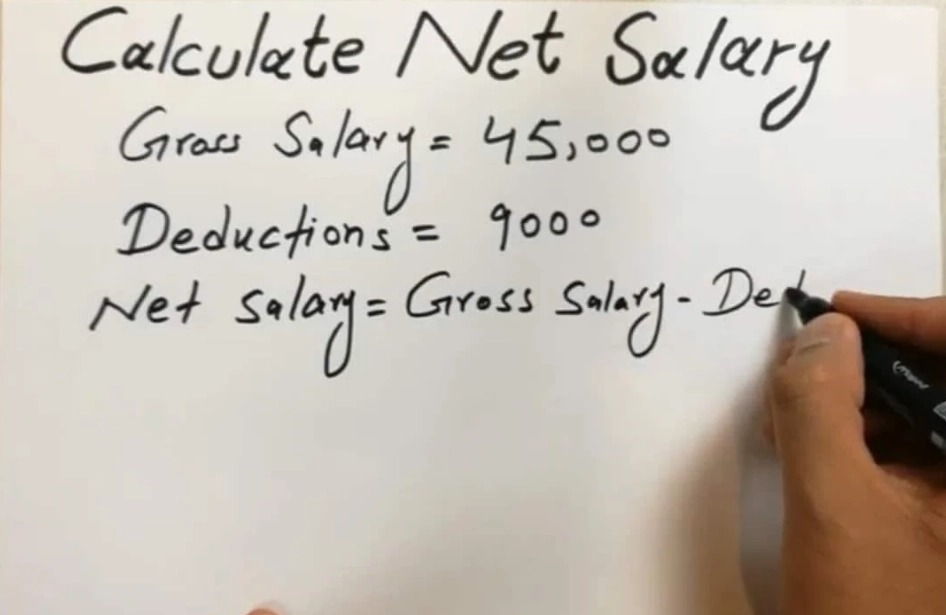

The formula is straightforward, but the devil is in the details. Here’s the basic net income formula:

Net Income = Total Revenue – Total Expenses

Too simple? Let's break it down into the actual components you'll see on an income statement. This is where understanding the meaning of net income gets practical.

The Income Statement Walk-Through

Imagine we have a small bakery, "Sweet Loaf." Here’s how its annual income statement might build up to net income:

| Line Item | Amount | Explanation |

|---|---|---|

| Total Revenue (Sales) | $200,000 | Money from selling bread, pastries, and coffee. |

| Cost of Goods Sold (COGS) | $80,000 | Flour, sugar, butter, coffee beans, packaging. |

| Gross Profit | $120,000 | Revenue - COGS. This is your profit from core activities before overhead. |

| Operating Expenses | $85,000 | Rent, utilities, salaries for counter staff, marketing, website. |

| Operating Income | $35,000 | Gross Profit - Operating Expenses. Profit from operations. |

| Interest Expense | $2,000 | Interest on a small business loan. |

| Taxes | $8,000 | Estimated income tax. |

| Net Income | $25,000 | The final profit. Operating Income - Interest - Taxes. |

See the journey? Revenue at the top, a bunch of subtractions, and net income at the very bottom. For Sweet Loaf, the net income meaning translates to $25,000 of true profit for the year that the owner can potentially take home or reinvest.

Net Income vs. Gross Profit: The Crucial Difference Everyone Misses

This is a huge source of confusion. People say "profit" and mean different things. Let's clear it up once and for all.

Gross Profit is your revenue minus only the direct costs of producing your product or service (COGS). It measures production efficiency. For Sweet Loaf, it's $120,000. It answers: "Are we pricing our bread correctly relative to the cost of ingredients?"

Net Income is the final profit after all expenses, including operating expenses (rent, salaries, marketing), interest, and taxes. It measures overall business health and efficiency. For Sweet Loaf, it's $25,000. It answers: "After paying for everything it takes to run this bakery, did we make money?"

You can have a healthy gross profit but a terrible (or negative) net income if your operating expenses are out of control. That was my friend's food truck problem.

Gross profit looks at your product.

Net income looks at your entire business.

What Factors Can Impact Your Net Income?

It's not just about selling more. The net income meaning is tied to a web of decisions. A change in any of these can swing your bottom line:

- Pricing Strategy: Raise prices? Revenue (and possibly net income) goes up, unless you lose customers.

- Cost Control: Negotiate a better rent or find a cheaper supplier for flour? Expenses go down, net income goes up.

- Operational Efficiency: Can you bake more loaves with the same labor (productivity)? Lowers cost per unit.

- Tax Planning: Legitimate deductions and credits directly increase your after-tax net income. The U.S. Small Business Administration has resources on business tax obligations.

- Accounting Methods: When you recognize revenue and expenses (cash vs. accrual accounting) can change your reported net income for a period, even if the cash hasn't moved.

- One-Time Events: Selling an old delivery van for a gain, or paying a lawsuit settlement. These can distort your "normal" net income.

Common Mistakes and Misconceptions About Net Income

Let's tackle some of the head-scratchers and face-palm moments I've seen (and personally experienced).

Another big one: Owner's Draws. If you're a sole proprietor or partner, the money you take out for yourself is not a business expense. It comes out of net income after it's calculated. This confuses people who think their draw is a salary expense.

Net Income in the Real World: Beyond Your Own Books

Understanding net income meaning isn't just for doing your own books. It's a lens to view the wider business world.

When you look at a public company's earnings report, the headline number is almost always its net income (or earnings per share, which is derived from it). Analysts pick it apart. Did net income grow? Did it beat expectations? Why or why not? This single number moves stock prices.

For example, if you read that "Company X reported a net income of $50 million for Q3," you now know that's their final, bottom-line profit after everything was accounted for. You can compare it to their $40 million net income from Q3 last year and see they're growing more profitable.

It's also critical for benchmarking. Industry associations often publish average net income margins (net income as a percentage of revenue). If the average net profit margin for retail is 3% and yours is 1%, it's a signal to investigate. Are your costs too high? Prices too low?

Frequently Asked Questions About Net Income

In common conversation, yes, "profit" often means net income. But technically, "profit" can be ambiguous—it could mean gross profit, operating profit, or net income. Net income is always the final, bottom-line profit. It's the most precise term.

Absolutely. It's called a net loss. It means your total expenses exceeded your total revenue for the period. It's a red flag, but not an immediate death sentence for startups or businesses investing heavily in growth. The key is understanding why it's negative.

On your Income Statement (Profit & Loss Statement). It's the very last line. If you use accounting software like QuickBooks or Xero, run a P&L report for any period, and scroll to the bottom.

At least monthly. You can't manage what you don't measure. A monthly review lets you spot trends, catch problems early, and make adjustments before a small dip turns into a quarterly disaster.

There's no universal number. A "good" net income is one that provides an acceptable return on your investment of time and money, allows for reinvestment, and meets your personal financial goals. A "good" net income margin varies wildly by industry. A software company might aim for 20%, while a grocery store might be thrilled with 2%.

Putting It All Together: Net Income as Your North Star

At the end of the day, grasping the full net income meaning is about empowerment. It takes the mystery out of your business's financial performance. It replaces gut feeling and guesswork with cold, hard data.

It's not the only metric that matters—cash flow is arguably more important for survival—but net income is the definitive scorekeeper for profitability. It's the number that tells you if your business model has a right to exist in the long term.

My advice? Make friends with your income statement. Get comfortable with the terms. Understand how each decision you make—hiring a new employee, launching a marketing campaign, buying a new piece of equipment—filters down to affect that final, all-important bottom line.

Start by calculating it for last month. Then ask yourself "why" it is what it is. That simple act will put you ahead of most small business owners. You'll stop just running a job for yourself and start strategically running a business.

Because when you truly understand your net income, you're not just reading a number. You're reading the story of your business.