Skip to What Matters

Equilibrium price isn't just some economics term you gloss over in class. It's the invisible hand that sets the price of your morning coffee, your Tesla stock, and even that vintage guitar you're eyeing on eBay. Get this wrong, and your portfolio might suffer. I learned that the hard way early in my trading career, chasing prices that were way out of whack with reality.

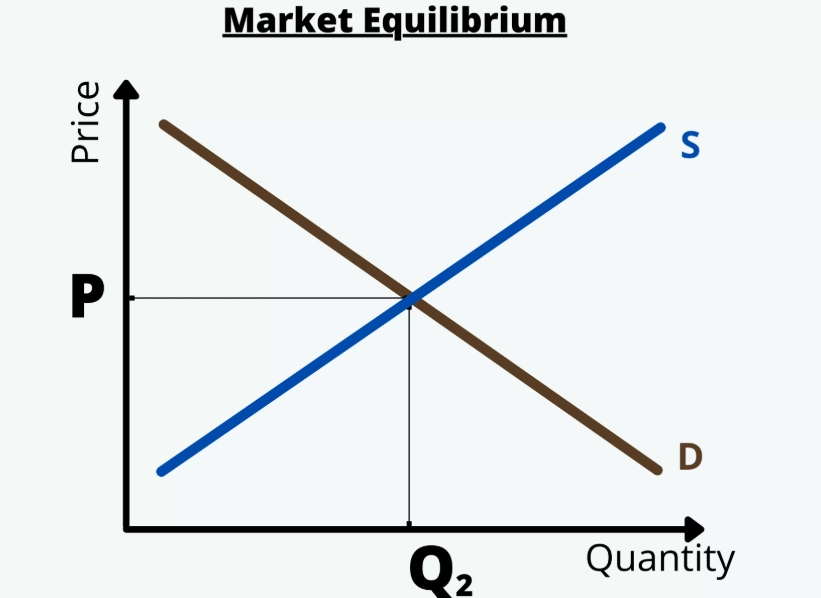

Let's cut through the jargon. Equilibrium price is where supply meets demand—no surplus, no shortage. But here's the kicker: it's never a fixed number. Markets breathe, and so does this point. Think of it like a seesaw that's constantly adjusting to weight shifts.

What Equilibrium Price Really Means (Forget the Textbook)

Textbooks show nice, clean lines crossing on a graph. Real life? Messy. Equilibrium price is more of a zone than a dot. When buyers and sellers agree on value, trades happen smoothly. If you've ever haggled at a flea market, you've felt this balance in action.

Supply and demand are the engines. Increase demand for sneakers during a trend, and prices jump until more supply kicks in. Decrease supply of semiconductors due to a factory fire, and prices soar until demand cools. The U.S. Bureau of Labor Statistics tracks these shifts in consumer markets, showing how dynamic this is.

The Supply and Demand Dance

Imagine you're selling lemonade. Hot day, more thirsty people—demand spikes. You raise prices until you can't make enough lemonade (supply limit). That's equilibrium. Now, if rain comes, demand drops, and you lower prices to clear stock. Simple, right? Apply this to stocks, and you'll see why earnings reports cause price swings.

How to Spot Equilibrium Price in Real Markets

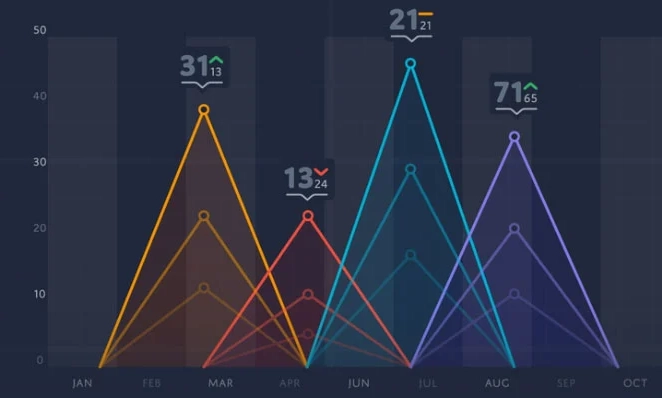

You don't need a PhD. Start with price charts. Look for areas where the price moves sideways for a while—consolidation zones. In forex, this might be a 50-pip range over days. In real estate, it's when homes in a neighborhood sell at similar prices for months.

Let's break it down with a table. Different markets show equilibrium differently:

| Market Type | Equilibrium Signal | What to Watch |

|---|---|---|

| Stock Market | Support/resistance levels | Trading volume—low volume at highs can indicate imbalance. |

| Commodities (e.g., Oil) | Inventory reports from EIA | Supply disruptions, geopolitical events. |

| Cryptocurrencies | Consolidation after volatility | Social media sentiment, regulatory news. |

| Housing Market | Months of supply data | Interest rate changes, local job growth. |

Case study time. Remember the 2020 oil crash? Prices went negative for WTI crude. Why? Storage capacity (supply) hit max, while demand plummeted from lockdowns. The equilibrium price temporarily vanished because the market couldn't balance. It wasn't a graph flaw—it was real-world chaos. Reports from the International Energy Agency highlighted how unprecedented this was.

Another example: iPhone launches. Apple sets a price based on predicted demand. If lines are long and stocks run out, they've underestimated demand—equilibrium price was higher. Next time, they might raise prices or boost production.

The Big Mistakes Everyone Makes

I'll be blunt. Most beginners treat equilibrium price like a magic number. They calculate it using old data and bet big. Then news hits, and they're stuck holding bags. The error? Assuming static conditions.

Here's a subtle one: ignoring liquidity. In thin markets like penny stocks, a few trades can skew the equilibrium. I once bought a small-cap stock thinking it was at balance, only to see it tank when a big seller dumped shares. The "true" equilibrium was lower because liquidity dried up.

Also, people over-rely on technical indicators like moving averages. Those lag. Equilibrium shifts in real-time with order flow. Watch the order book if you can—it shows live bids and asks.

Using Equilibrium Price to Make Smarter Moves

So, how do you use this without getting burned? First, accept it's a range. In trading, buy near the lower end of an equilibrium zone, sell near the upper end. For long-term investing, look for markets where price is below historical equilibrium—potential value spots.

Practical Tips for Different Asset Classes

Stocks: Check if the current price aligns with earnings growth and industry trends. If everyone's bullish but prices stall, equilibrium might be lower. Use resources like SEC filings for supply-side data.

Forex: Central bank policies shift demand. A rate hike can push equilibrium up for a currency. Monitor statements from the Federal Reserve or ECB.

Real Estate: Equilibrium here is slow-moving. Look at months of inventory—6 months often signals balance. Above that, it's a buyer's market; below, seller's.

Personal story: I used this in 2019 with gold. Prices were range-bound between $1,200 and $1,300 for months. That was the equilibrium zone. When geopolitical tensions rose, demand increased, and I bought near $1,200. It eventually broke out to $1,500. The key was patience and watching for shifts in demand cues.

Your Burning Questions Answered

Wrapping up, equilibrium price is your friend if you respect its fluidity. Don't overcomplicate it. Watch supply and demand signals in your market of choice, stay updated with reliable sources like central bank reports or industry analyses, and always factor in the human element—sentiment matters more than models admit.

Got more questions? Drop a comment. I've been trading for over a decade, and this stuff still keeps me on my toes. Markets evolve, and so should your understanding of balance.