Let's cut through the accounting jargon. Retained earnings are simply the total profits a company has earned over its entire life, minus any dividends it has paid out to shareholders. Think of it as the company's cumulative savings account, funded by its own success. It's not cash sitting in a vault (a common misconception), but a claim on assets that can be used to grow the business, pay down debt, or reward owners later. For investors, this number on the balance sheet is a history book and a strategy statement rolled into one. It tells you what management has done with the money the business made.

What You'll Learn in This Guide

- What Retained Earnings Actually Mean (Beyond the Textbook)

- The Retained Earnings Formula, Demystified

- How to Read the Statement of Retained Earnings

- Where to Find Retained Earnings on the Balance Sheet

- How to Analyze Retained Earnings Like a Pro

- Real-World Cases: Apple, Tesla, and Amazon

- Common Mistakes People Make (And How to Avoid Them)

- Your Burning Questions, Answered

What Retained Earnings Actually Mean (Beyond the Textbook)

Every finance textbook defines retained earnings. But on the ground, it represents management's capital allocation track record. Did they plow profits back into successful projects? Did they fumble reinvestments? Or did they send most of the money back to shareholders?

It's part of shareholders' equity. When you see a healthy, growing retained earnings balance, it generally signals a company that can fund its own growth without constantly borrowing or issuing new stock. That's a sign of strength and maturity.

What is the Retained Earnings Formula?

The calculation is straightforward, but each piece tells a story.

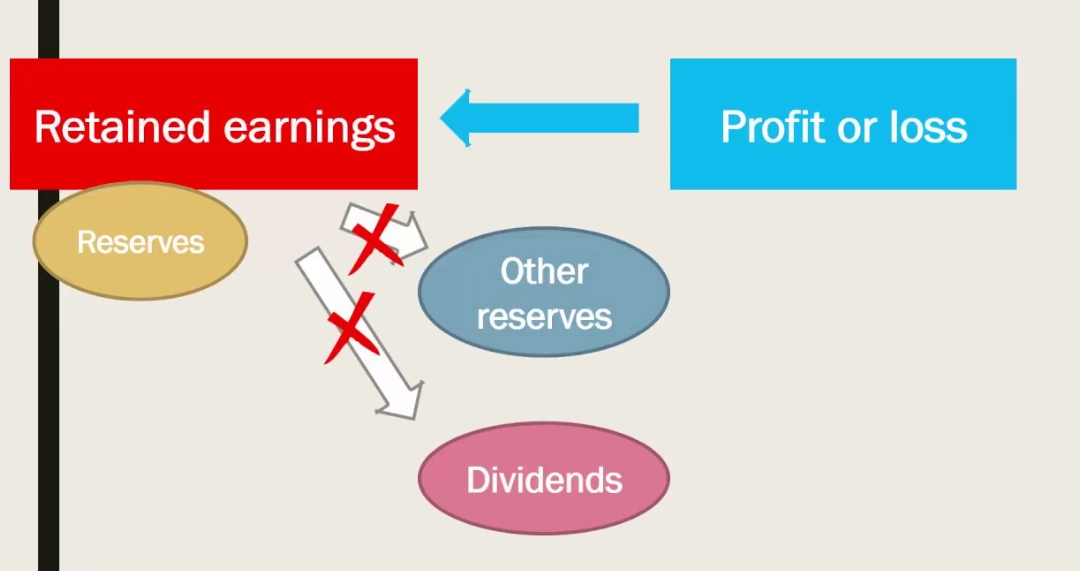

Retained Earnings (Ending) = Beginning Retained Earnings + Net Income/Loss – Dividends Paid

- Beginning Retained Earnings: Last period's ending balance. This is the starting point, the history carried forward.

- Net Income/Loss: The profit or loss from the current period's operations (from the income statement). This is the new money coming in.

- Dividends Paid: Cash or stock dividends distributed to shareholders. This is money going out the door to owners.

Let's walk through a concrete example with a fictional company, “StableGrow Inc.”

| Description | Amount | Explanation |

|---|---|---|

| Beginning Retained Earnings (Jan 1) | $500,000 | What was saved up from all prior years. |

| Plus: Net Income for the Year | $200,000 | Profit earned this year from selling goods/services. |

| Subtotal | $700,000 | Total profit available before paying owners. |

| Less: Cash Dividends Paid | ($50,000) | Money returned to shareholders. |

| Ending Retained Earnings (Dec 31) | $650,000 | The new cumulative savings balance. |

See the story? StableGrow earned $200K, paid out $50K to shareholders, and kept $150K in the business. The retained earnings grew from $500K to $650K. That $150K increase is now available to buy new equipment, hire staff, or launch a marketing campaign.

How to Read the Statement of Retained Earnings

This is often a separate statement or part of the statement of changes in equity. It's the reconciliation that shows the formula in action. Public companies file these with the SEC, and you can find them in their annual 10-K or quarterly 10-Q reports on the EDGAR database.

Here’s what a real one looks like, simplified from a typical annual report:

Consolidated Statements of Retained Earnings

For the Year Ended December 31, 2023

(in thousands)

| Retained earnings, beginning of year | $1,250,000 |

| Net income | $425,000 |

| Dividends declared ($1.00 per share) | ($125,000) |

| Other comprehensive income (loss) | $15,000 |

| Retained earnings, end of year | $1,565,000 |

Notice the line “Other comprehensive income.” This is where it gets nuanced. Sometimes gains or losses that bypass the income statement (like certain foreign currency adjustments) go directly to equity, affecting retained earnings. It’s a detail, but it explains why the change isn't always just “Net Income minus Dividends.”

Where to Find Retained Earnings on the Balance Sheet

It's always in the shareholders' equity section. Always. Look at the bottom of the balance sheet.

Shareholders' Equity

Common Stock: $100,000

Additional Paid-In Capital: $400,000

Retained Earnings: $650,000

Total Shareholders' Equity: $1,150,000

The other equity accounts (Common Stock, Paid-In Capital) represent money invested into the company by shareholders. Retained Earnings represent money earned by the company. Together, they show all the sources of the company's equity.

How to Analyze Retained Earnings Like a Pro

This is where you move from reading numbers to reading strategy. Don't just look at the single figure.

1. Look at the Trend Over 5-10 Years

Pull up old financials. Is the line consistently sloping upward? That's a sign of sustained profitability and conservative dividend payments. Is it flat? Maybe the company pays out most profits as dividends. Is it jagged? There might be years with big losses or special dividends. The trend is your best friend.

2. Compare to Net Income

Calculate the Retention Ratio: (Net Income – Dividends) / Net Income. A ratio of 0.8 means the company retains 80% of its earnings. A mature utility company might have a low ratio (high payout). A tech startup should have a ratio near 1.0 (reinvesting everything).

3. Benchmark Against the Industry

A capital-intensive industry like manufacturing will typically have higher retained earnings to fund new factories. A software company might have less because its assets (code, people) aren't as heavy on the balance sheet. Compare apples to apples.

4. Understand the Company's Lifecycle Stage

- Growth Stage: Retained earnings should be rising rapidly. Dividends are minimal or zero. All profits are fuel for expansion. Think Tesla in its high-growth phase.

- Mature Stage: Steady, predictable growth in retained earnings, coupled with regular dividends. The retention ratio is balanced. Think Procter & Gamble.

- Declining/Transition Stage: Retained earnings may stagnate or fall as profits shrink. The company might dip into old retained earnings to pay dividends, which is unsustainable.

Real-World Cases: What Retained Earnings Tell Us About Apple, Tesla, and Amazon

Let's apply this to companies you know.

Apple Inc. has one of the largest retained earnings balances in the world—over $5 billion as of recent reports. For years, its retention ratio was very high; it reinvested heavily and didn't pay dividends. This built a war chest. Now, as a mature cash machine, it pays substantial dividends and does massive stock buybacks, but its retained earnings still grow because its net income is so enormous. The story: immense profitability leading to strategic flexibility.

Tesla, Inc. had an accumulated deficit (negative retained earnings) for most of its history because it burned cash to scale production. Only in recent years, as it achieved consistent profitability, has its retained earnings turned positive and started growing. The trend from deeply negative to positive is a powerful signal of a business model finally working at scale.

Amazon.com, Inc. is the classic example of the “negative retained earnings” puzzle. For decades, it reinvested every dollar (and more) into growth, showing little profit on the income statement. Its retained earnings were deeply negative due to early losses. Even now, with massive profits, that old deficit lingers on the balance sheet. It doesn't reflect current health but historical strategy. You have to look at cash flow and net income trends alongside it.

Common Mistakes People Make (And How to Avoid Them)

I've seen these errors trip up even seasoned analysts.

Mistake 1: Confusing retained earnings with cash. They are not the same! Retained earnings have been used to buy inventory, property, and equipment. The cash is gone, transformed into assets. Check the cash flow statement to see actual liquidity.

Mistake 2: Ignoring the impact of stock dividends and splits. A stock dividend moves value from retained earnings to paid-in capital accounts but doesn't change total equity. It's a reshuffling. Don't let it distract you from the core profitability story.

Mistake 3: Overemphasizing a single year's change. A one-year dip could be due to a special, one-time dividend. A spike could be from a large asset sale. Look at the multi-year trend for the true picture.

Mistake 4: Not connecting it to return on equity (ROE). ROE = Net Income / Shareholders' Equity. If retained earnings are a large part of equity and growing, the company needs to generate strong net income to maintain a healthy ROE. Stagnant profits with growing retained earnings will drag ROE down.

Your Burning Questions, Answered

Why would a profitable company like Amazon have negative retained earnings?

Is a high retained earnings balance always a good sign for investors?

How do stock buybacks (share repurchases) affect retained earnings?

What's the biggest mistake beginners make when analyzing retained earnings?

So, the next time you look at a balance sheet, don't just glance at retained earnings. Stop and think about the story. Is this a company saving for a big future, or one generously sharing its success? The answer, hidden in that one line item, reveals the heart of a company's financial strategy.