Your Quick Guide

- Why Should You Even Care About Retained Earnings?

- The Retained Earnings Formula: How It's Actually Calculated

- Retained Earnings vs Dividends: The Fundamental Tug-of-War

- Where Do You Find Retained Earnings on Financial Statements?

- What Can High or Low Retained Earnings Actually Tell You?

- The Downsides and Misconceptions About Retained Earnings

- Common Questions People Actually Ask About Retained Earnings

- Putting It All Together: A Practical Lens for Decisions

Let's talk about a number on the balance sheet that doesn't get enough love, but tells you a massive story about a company's past, present, and future. I'm talking about retained earnings. You've probably seen the term if you've ever glanced at a financial statement. It sits there in the shareholders' equity section, sometimes with a huge positive number, sometimes negative, and for new companies, often zero.

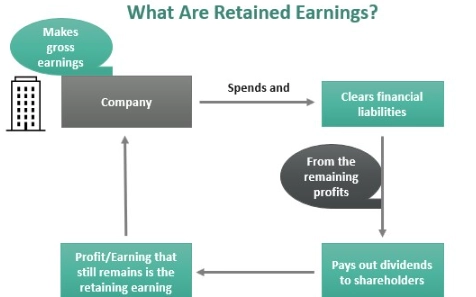

But what is retained earnings, really? In the simplest terms, it's the total amount of profit a company has earned since it started, minus all the dividends it has ever paid out to its owners. It's the pile of cash (well, not literally always cash, but we'll get to that) that the business has chosen to keep and reinvest in itself rather than hand out. Think of it as the company's savings account for growth.

Retained Earnings Definition: Retained earnings represent the cumulative net income or profit of a company after accounting for dividend payments. It's the portion of earnings not distributed to shareholders but kept by the company to reinvest in its core business or to pay down debt.

It's a critical concept, whether you're a small business owner trying to figure out if you can afford a new piece of equipment, an investor sizing up a potential stock purchase, or a student wrestling with accounting principles. The story of what is retained earnings is fundamentally the story of how a company fuels its own engine.

Why Should You Even Care About Retained Earnings?

Good question. It feels like an accounting technicality, right? But it's not. It's a direct report card on management's capital allocation strategy.

When a company makes money, it has two basic choices: give it to the owners (dividends) or keep it (retention). The decision of what to do with that profit speaks volumes. A company with steadily growing retained earnings is typically plowing money back into research, expansion, marketing, or paying off loans to get stronger. A company that pays out most of its earnings might be a mature, stable business with fewer growth opportunities—think of your classic utility or consumer staples stock.

And a company with negative retained earnings? That's often called an accumulated deficit. It means the company has lost more money, cumulatively, than it has made. That's a huge red flag for any investor or creditor, signaling potential trouble unless it's a startup in its investment phase. Understanding what retained earnings are helps you peek into this strategic decision-making process.

I remember looking at the financials of a trendy tech startup a few years back. They had amazing revenue growth, but their retained earnings were deep in the negative, burning through investor cash. It made me skeptical of the hype. Sure enough, they struggled to become profitable. That number told a clearer story than the marketing headlines.

The Retained Earnings Formula: How It's Actually Calculated

It's not magic, it's arithmetic. The formula for retained earnings is refreshingly straightforward. You can find it on any decent balance sheet, but knowing how it ticks is empowering.

The classic retained earnings formula is:

Ending Retained Earnings = Beginning Retained Earnings + Net Income/Loss – Dividends Paid

Let's break that down because it's the heart of the matter.

- Beginning Retained Earnings: This is just last period's ending retained earnings. It's the carry-over balance from all of history up until the start of the current year or quarter.

- Net Income/Loss: This comes straight from the current period's income statement. Did the company make money this quarter? Add it. Did it lose money? Subtract it.

- Dividends Paid: This includes all cash dividends paid out to shareholders during the period. Sometimes stock dividends or other distributions are handled here too, but cash is the main event.

So, the formula tracks the running total. It starts with what you had, adds what you made (or subtracts what you lost), and then takes away what you gave away. What's left is your new retained earnings balance.

Here's a quick example to make it concrete. Imagine "Joe's Coffee Co."

| Item | Amount |

|---|---|

| Beginning Retained Earnings (Jan 1) | $50,000 |

| Plus: Net Income for the Year | $30,000 |

| Minus: Dividends Paid to Shareholders | ($10,000) |

| Ending Retained Earnings (Dec 31) | $70,000 |

See? Joe started with $50k in the "growth fund," made $30k profit this year, paid out $10k to the owners, and now has $70k left to reinvest in a new espresso machine, a second location, or a marketing blitz. That's the retained earnings meaning in action.

A Quick Word on the Statement of Retained Earnings

Sometimes you'll see a separate little statement called the Statement of Retained Earnings. It's not as famous as the income statement or balance sheet, but it's useful. It literally just lays out the formula we discussed above. It's the bridge that connects the net income on the income statement to the equity section on the balance sheet. The U.S. Securities and Exchange Commission (SEC) requires public companies to present changes in equity, which includes this reconciliation, so investors can track the flow.

Retained Earnings vs Dividends: The Fundamental Tug-of-War

This is where the rubber meets the road for management and investors. The retained earnings vs dividends decision is a constant balancing act.

On one side, you have shareholders who might want income now (dividends). On the other side, you have the potential for future growth if you reinvest the money (higher retained earnings). There's no one right answer—it depends entirely on the company's life stage and opportunities.

Growth Companies (Tech, Biotech Startups): These often have zero or minimal dividends. They retain almost all earnings (or reinvest even more than they earn, leading to losses) to fund rapid expansion, R&D, and customer acquisition. Think of Amazon in its early decades. Their retained earnings story was all about massive reinvestment.

Mature, Cash-Cow Companies (Utilities, Big Pharma, Consumer Brands): These businesses often have stable, predictable profits but fewer explosive growth opportunities. They tend to pay out a significant portion of earnings as dividends. Their retained earnings might grow slowly, as they only keep what's needed for maintenance and small upgrades.

The tension is real. Pay too much in dividends, and you might starve the business of funds needed to stay competitive. Retain too much, and shareholders might get frustrated if they don't see that money being used effectively to generate higher future returns. It's a key thing to analyze when you're trying to understand what is retained earnings signaling about a company's strategy.

I've seen companies get this wrong. A once-dominant retailer kept paying fat dividends while its stores became outdated and online competition ate its lunch. Its retained earnings stagnated, and so did its future. The dividends looked good for a while, but the share price tanked because no growth was being funded.

Where Do You Find Retained Earnings on Financial Statements?

This is practical stuff. You won't find it on the income statement—that's just for revenue and expenses for a period. The home of retained earnings is the Balance Sheet, specifically under the Shareholders' Equity section.

Equity is basically what's left over after you subtract all liabilities (debts) from all assets. And shareholders' equity is made up of a few pieces:

- Paid-in Capital: Money investors put in directly by buying stock.

- Retained Earnings: Money the company earned and kept.

- Treasury Stock: (If any) The cost of shares the company bought back.

- Other Comprehensive Income: (Sometimes) Certain unrealized gains/losses.

So, when you look at a balance sheet, scan down to the equity part. You'll see a line item clearly labeled "Retained Earnings" or "Accumulated Retained Earnings." That's your number. For a real-world example, you can pull up any public company's 10-K annual report on the SEC's EDGAR database and see it in the wild.

What Can High or Low Retained Earnings Actually Tell You?

The raw number itself is less important than the trend and the context. Let's interpret some scenarios.

A Steadily Growing Positive Balance

This is generally healthy. It suggests consistent profitability and a management team that is successfully reinvesting profits to generate more profits. It builds a war chest for economic downturns or strategic acquisitions. It's a sign of a financially resilient business.

A Large, Sudden Jump

Could be great—maybe the company had a blockbuster year. But ask why. Did they stop paying dividends? Did they sell a major asset? Dig into the notes of the financial statements to see the story behind the jump.

Negative Retained Earnings (Accumulated Deficit)

This screams "caution." It means total lifetime losses exceed total lifetime profits. Common for startups and biotechs in the R&D phase, but a major red flag for an established company. It can limit the ability to pay dividends (legally, in many jurisdictions) and may indicate fundamental business problems. It can also erode the total equity, making the company look riskier to lenders.

A Warning: Don't confuse high retained earnings with high cash balances. Retained earnings is an accounting concept, not a cash account. The company could have reinvested that money into factories, inventory, or patents—assets that aren't cash. A company can have massive retained earnings and be cash-poor if its assets are tied up illiquid forms. Always check the cash flow statement!

The Downsides and Misconceptions About Retained Earnings

It's not all sunshine and rainbows. There are legitimate criticisms and pitfalls.

First, management might misuse retained earnings. Instead of investing in high-return projects, they might hoard cash inefficiently, make overpriced acquisitions to fuel ego, or invest in pet projects with low returns. This is called an "agency problem"—where management's interests (building an empire) don't align with shareholders' interests (maximum return).

Second, from a tax perspective, retained earnings can sometimes be less efficient. In some situations, shareholders might prefer dividends (despite the immediate tax hit) so they can reinvest the after-tax proceeds themselves, perhaps at a higher return than the company can achieve.

And the biggest misconception? That retained earnings is money sitting in a bank vault. I can't stress this enough. When you grasp what retained earnings are, you must understand they represent value that has been redeployed into the business. It's in the new trucks, the expanded warehouse, the reduced debt, the bigger staff. It's not a savings account number you can just withdraw.

Common Questions People Actually Ask About Retained Earnings

Putting It All Together: A Practical Lens for Decisions

So, after all this, how do you use your understanding of what is retained earnings?

If you're an investor: Look at the trend. Is it growing steadily in line with or faster than revenue? How does the retention rate (percent of earnings kept) compare to industry peers? Does the company have a clear and successful history of reinvesting its retained earnings (evidenced by growth in ROE or ROA)? A negative trend or a large accumulated deficit warrants deep scrutiny.

If you're a small business owner: Your retained earnings balance is your primary source of internal funding for growth. Before you take out a high-interest loan, check this pool. A strong retained earnings balance gives you bargaining power with banks. It also represents your business's financial maturity and stability.

If you're analyzing a company (for a job, a report, etc.): Don't just note the number. Connect the dots. Link the change in retained earnings from the balance sheet to the net income on the income statement and the dividend payments on the cash flow statement. This triangulation gives you a complete picture of profitability and distribution policy.

It's one of those numbers that seems quiet but shouts if you know how to listen.

Ultimately, asking "what is retained earnings" is asking how a company stewards its success. Is it feeding the golden goose for more eggs, or is it just serving the eggs for dinner today? The answer, found in that single line item in the equity section, reveals a huge part of a company's character and its roadmap for the future. It's not just accounting—it's the story of ambition, discipline, and strategy, told in dollars and cents.