Quick Navigation

Let's talk about money. More specifically, let's talk about the money you hand over to the state government every year. For a lot of people, the idea of living in one of the so-called no tax states sounds like a dream. Keep every dollar you earn? Sign me up! I've had friends who've packed their bags for Texas or Florida, basically chanting "no state income tax" like a mantra. But here's the thing I've learned from watching them—and from digging into the numbers myself: it's never that simple.

The dream is real, but the reality has layers. Moving for tax reasons alone can be a bit of a gamble if you don't know what you're getting into. Is it all sunshine and extra cash, or are there hidden trade-offs? I wanted to cut through the hype and get to the real story. So, we're going to break it down, state by state, dollar by dollar.

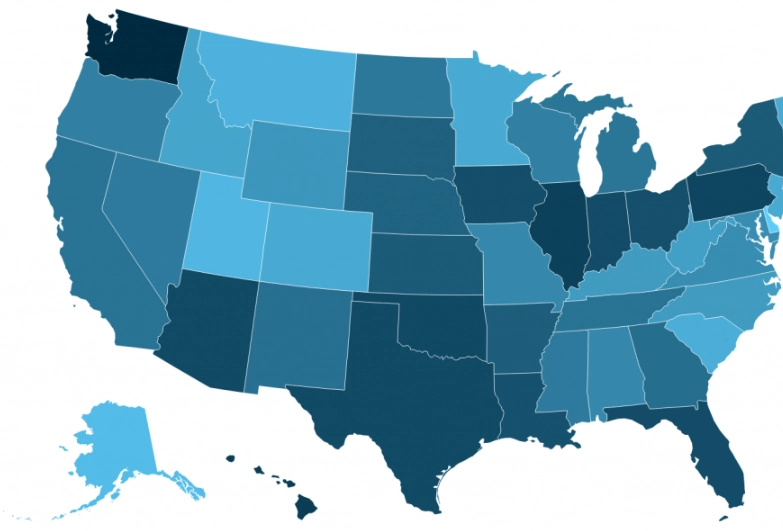

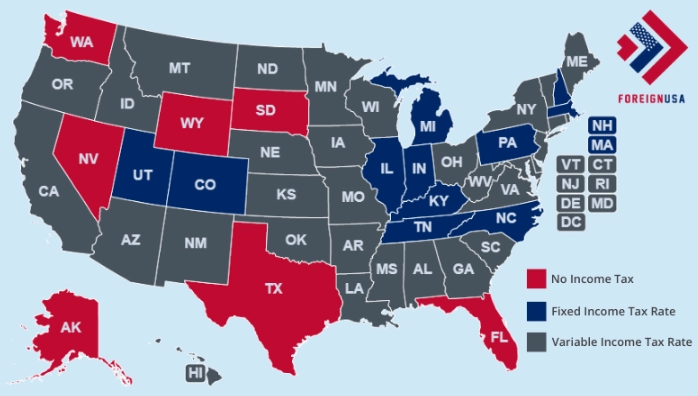

When people say "no tax states," they're specifically talking about states that do not levy a broad-based personal state income tax. That's key. They might tax your investments or a tiny portion of interest/dividends, but your regular paycheck from a job is safe. According to the nonpartisan Tax Foundation, there are nine of them. Don't let anyone tell you there are seven or eight—it's nine.

| State | Nickname / Vibe | The Core Tax Deal | What They Get You On Instead (Often) |

|---|---|---|---|

| Alaska | The Frontier | No income tax, and they often PAY you (PFD) | Higher cost of living for goods, remote logistics |

| Florida | The Sunshine Magnet | No income tax, huge retiree draw | Tourist-driven sales tax, property insurance |

| Nevada | The Entertainment Hub | No income tax, built on tourism taxes | Sales tax, gaming/gas taxes |

| New Hampshire | The Live Free or Die State | No tax on earned wages | High property taxes, taxes interest/dividends |

| South Dakota | The Quiet Haven | No income tax, business-friendly | Sales tax, sometimes higher sin taxes |

| Tennessee | The Music & Mountains State | No tax on wages (phased out fully in 2021) | One of the highest sales tax rates in the US |

| Texas | The Everything-is-Big State | No income tax, proud of it | High property taxes, sales tax |

| Washington | The Pacific Northwest Tech Hub | No income tax on any earnings | High sales tax, gas tax, potential capital gains tax |

| Wyoming | The Cowboy State | No income tax, mineral wealth funded | Sales tax, property tax can vary |

See? Just listing them out already shows they're not all the same. Alaska uses oil money to cut residents checks, while Tennessee makes up for it at the cash register. It's a classic trade-off.

The Real Pros and Cons of Living in a No Income Tax State

Okay, so you're eyeing that list. Before you start browsing real estate websites, let's have an honest chat about the good, the bad, and the "it depends." I've seen people get overly fixated on the zero income tax rate and miss the bigger financial picture.

The Upsides (They're Legit)

- More Take-Home Pay (Usually): This is the big one. If you're a high earner—say, a software engineer, doctor, or successful consultant—keeping an extra 5-10% of your income is life-changing money. For someone making $200,000, that's $10,000 to $20,000 a year staying in your pocket. That's a car payment, a killer vacation, or serious extra savings.

- Simplicity: Filing taxes is easier. No complicated state tax forms, no worrying about withholding the right amount for the state. You still have federal, of course, but one less headache is nice.

- A Magnet for Certain People: It's no accident that Florida and Texas are population boom states. Retirees on fixed incomes love preserving their IRA/401(k) withdrawals. Remote workers see a clear arbitrage opportunity. Entrepreneurs and business owners often find a more favorable overall tax structure.

- Perceived Business Friendliness: States like Texas, Tennessee, and Nevada aggressively market their no-tax status to attract companies. This can lead to more job opportunities in the long run.

The Downsides (The Fine Print)

- They Get You Elsewhere: Governments need revenue. Period. If not from income tax, then from sales tax, property tax, sin taxes (alcohol, tobacco), or fees. Texas has famously high property taxes. Tennessee and Washington have high sales taxes. You're not escaping tax; you're just paying it through a different channel.

- Cost of Living is King: A zero income tax rate means nothing if your housing costs double. Look at Seattle, Washington, or parts of Florida. The savings on income tax can be utterly swallowed by a higher mortgage or rent. You have to run the numbers for your specific situation.

- Public Services Can Vary: This is a touchy one, but it's a real consideration. Some tax free states have lower per-capita spending on things like public education, social services, or infrastructure. This isn't universally true (some fund services well through other taxes), but it's a question worth asking: Are the public schools, parks, and roads in the condition you expect?

- The "Hidden" Tax of Insurance: This one hit my friend in Florida hard. His property insurance premium tripled in five years due to hurricane risk. That's an enormous, unpredictable cost that acts just like a tax. In Texas, consider flood and windstorm insurance. In Washington, earthquake coverage.

Who Actually Benefits the Most from Moving to a No Tax State?

This is the million-dollar question. The benefit isn't evenly distributed. Let's be real.

If you're a young professional with a modest income renting an apartment, moving from a low-tax state to a high-cost no tax state might leave you worse off. The math has to work.

Here's who tends to win in the move to states with no income tax:

- High-Income Earners & Professionals: This is the clearest win. The more you make, the more you save. A surgeon, a lawyer partner, a tech executive—they save tens of thousands annually. For them, even higher property taxes are often a net win.

- Retirees with Significant Retirement Account Income: If you're living off distributions from a 401(k) or IRA, that money is taxable at the state level in most places. In Florida or Nevada? Not a dime. This is why retirement communities there are everywhere. The IRS still gets theirs, but the state doesn't.

- Remote Workers with Location Flexibility: The pandemic changed the game. If your company is based in California or New York but lets you work remotely, moving to a no tax state can be a massive financial upgrade without changing your salary. (Note: Some companies are adjusting pay for location, so check your policy!).

- Business Owners (Especially Pass-Through Entities): If your business income "passes through" to your personal return (like an S-Corp or LLC), avoiding state income tax on that profit is huge. It directly increases your capital for reinvestment or personal use.

- People with Large Capital Gains or Investment Income: While some states tax investments, many of the no tax states do not. Selling a business, a stock portfolio, or other assets can trigger massive tax savings.

Personal Anecdote Time: I know a freelance graphic designer who moved from Oregon (high income tax) to Washington (no income tax). She works for clients all over the world. Her taxable income is around $90k. In Oregon, she'd pay about $8,000 in state taxes. In Washington, she pays $0. Even with slightly higher sales tax, she came out thousands ahead. For her, it was a no-brainer. But she also didn't have kids, so she wasn't weighing public school quality heavily.

The Decision Framework: How to Actually Decide If a Move is Right for You

Don't just jump. Calculate. Here's a step-by-step way to think it through, the way a financial planner might (but in plain English).

Step 1: Run Your Own Personal Tax Comparison

This is grunt work, but it's essential. Don't guess.

- First, figure out what your state income tax liability is right now. Pull out last year's return or use an online calculator.

- Second, pick a target city in your desired no tax state. Let's say you're comparing suburban Chicago to suburban Dallas.

- Use a cost-of-living calculator (like the one from the Bureau of Labor Statistics) to compare housing, groceries, utilities, and transportation. These are your major buckets.

- Now, research the specific other taxes. What's the property tax rate for a comparable home? (Check the county auditor site). What's the combined state and local sales tax rate? (The Tax Foundation has great maps).

- Build a simple spreadsheet. Put your estimated income tax savings in one column. In the other, add the estimated increase in housing, property tax, sales tax (estimate based on spending), and insurance.

The bottom line number is what matters. Is it positive or negative?

Step 2: Look Beyond the Dollars

Money isn't everything. Well, it's a lot, but not everything.

- Lifestyle Fit: Do you hate humidity? Florida might be a financially great but miserable choice. Love hiking and mountains? Washington or Tennessee could be perfect. Hate driving everywhere? Some no tax states have minimal public transit.

- Family & Community: Uprooting kids from schools and friends is a huge cost. Are there job opportunities for your spouse? Is there a community you connect with?

- Long-Term Trends: Is the state fiscally stable? Are they running deficits that might pressure them to *introduce* an income tax? (It's rare but has been threatened in some). Washington's recent capital gains tax shows the landscape can shift.

Step 3: Consider a "Test Drive"

If it's feasible, rent for a few months before you buy. Experience the summer heat, the traffic, the local culture. Talk to neighbors about what they pay in property insurance and utilities. This real-world intel is worth more than a thousand online articles.

Even with all this planning, you might find the financial benefit is marginal. And that's okay. The goal isn't to move at all costs; it's to make an informed decision that improves your overall life, not just one line item on a budget.

Common Questions (And Straight Answers) About No Tax States

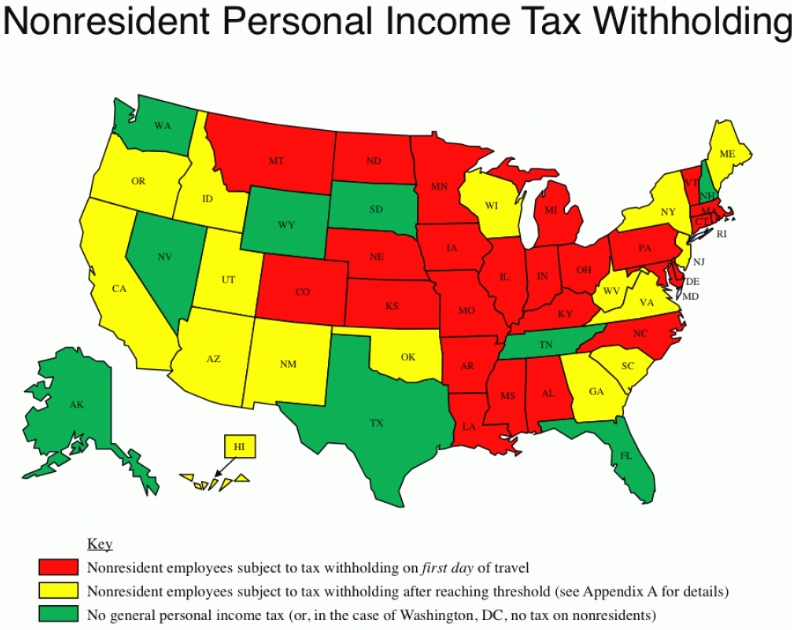

If I work remotely for a company in California, and move to Texas, do I pay California tax?

Generally, no. You pay income tax based on your state of residence, not where your company is headquartered. If you establish legal residency in Texas (get a driver's license, register to vote, etc.), your wages are taxed only by the federal government. However, be scrupulous about this. Some states, like New York, have tricky "convenience of the employer" rules that can still tax you if they deem your move was for convenience, not necessity. California isn't as aggressive on this front for employees, but the rules are complex.

Do no tax states have higher sales taxes?

Often, yes. They need revenue from somewhere. According to the Tax Foundation, Tennessee (9.55% avg combined rate), Louisiana (9.55%), and Washington (9.38%) have some of the highest combined state and local sales tax rates in the country. Alaska is the exception—it has low average sales tax and no income tax, but again, high costs elsewhere.

What about property taxes in states with no income tax?

This is where it gets interesting. Texas and New Hampshire have some of the highest effective property tax rates in the U.S. You're essentially swapping an income tax bill for a bigger property tax bill. But if you're a renter, you don't pay property tax directly (though it's factored into your rent). This makes no tax states potentially more favorable for renters than for homeowners, depending on the local market.

Are there any states with no sales tax AND no income tax?

Yes, but it's a trick. Alaska has no state-level sales tax and no state income tax. However, local municipalities in Alaska can and do impose sales taxes, and the cost of living is extraordinarily high, negating much of the benefit for most people. Delaware has no sales tax but does have a state income tax. So, the pure "no tax" dream doesn't really exist in a practical sense.

Is it worth moving to a no-tax state when I retire?

For many, absolutely. This is one of the most powerful moves you can make. You are converting taxable retirement account distributions into tax-free income at the state level. Combine that with a lower cost-of-living area in a state like Tennessee or Florida, and your retirement savings stretch significantly further. It's why Florida's population is so heavily skewed toward retirees. Just do the full cost analysis—some retirees are shocked by high HOA fees or insurance costs in popular retirement communities.

The Bottom Line: It's a Tool, Not a Magic Wand

Look, the idea of no tax states is powerful. It represents freedom, control, and keeping more of what you earn. And for the right person in the right circumstances, it can be a fantastic financial decision.

But please, don't fall for the oversimplified marketing. I've seen too many articles that just list the states and call it a day. The real value is in understanding the system of taxation you're entering.

Your mission, should you choose to accept it, is to become a total-cost analyst for your own life. Add up the income tax savings. Subtract the likely increases in housing, property tax, sales tax, and insurance. Then, and only then, add in the intangible factors of lifestyle, family, and community.

The nine states with no income tax offer a unique proposition in the American landscape. They're not a utopia, and they're not a scam. They're an option—a potentially very lucrative one—with a specific set of trade-offs. Your job is to decide if those trade-offs are worth it for you and your family. Now you have the framework to figure that out.

Honestly, sometimes the best move is to stay put and find other ways to optimize your finances. But if the numbers work and the life fits, pulling the trigger on a move to one of these states could be one of the best financial decisions you ever make. Just go in with your eyes wide open.